AMD Expands Market With OpenAI Deal

AMD has made a big gain in its race against archrival NVIDIA. In news this weekend, the world’s second-largest GPU supplier announced a highly structured deal with OpenAI to deliver hundreds of thousands of its chips to the AI startup, plus an option for OpenAI to acquire a roughly 10% stake in AMD.

The arrangement calls for AMD to supply 6 gigawatts' worth of GPU power over a five-year period to the AI startup, along with a warrant agreement that would allow OpenAI to buy up to 160 million shares of AMD stock at a penny per share. On the surface, the deal does involve a trade of equity for business, but in the scheme of things—with huge GPU deals dropping almost daily— it appears to be a savvy move by AMD to keep up with rival NVIDIA and possibly gain market share.

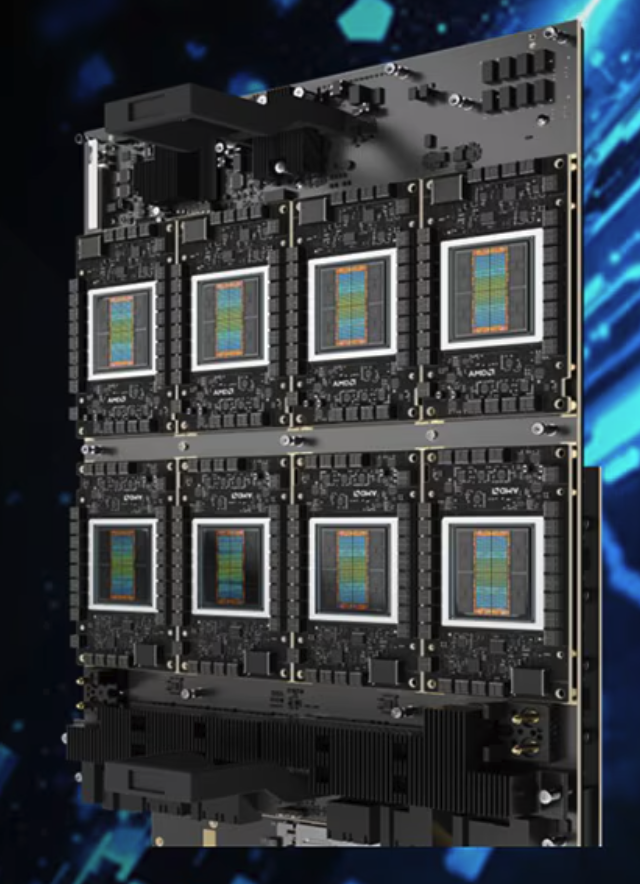

The deal involves AMD’s MI450 GPUs and Helios rack system, which are set for general availability in the second half of 2026, a timeframe often mentioned in chip-supply deals. AMD CEO Lisa Su told investors today that she expects revenue from OpenAI to begin at that time, adding that she anticipates “double-digit billions of annual incremental datacenter AI revenues once [the arrangement] ramps.” Over the next several years, Su said AMD could realize $100 billion from the deal.

AMD accelerators. Source: AMD

A Structured Arrangement

The arrangement between AMD and OpenAI is set up to “strategically align the interests of both companies,” according to CEO Su, unlike the more generalized recent announcements by OpenAI (e.g., the $100 billion circular deal with NVIDIA and the $300 billion contract with Oracle). Both of those announcements raised major concerns over OpenAI’s ability to pay for all these commitments.

OpenAI has told investors that it could see $13 billion in revenue this year but not post a profit until 2029—by which time it could burn through $115 billion. (Compare that to the $33 billion Wall Street expects AMD to post in sales this year.)

In contrast with other deals, OpenAI’s potential stake in AMD will be delivered in tranches that are based on the performance of both companies. The first tranche vests on deployment of OpenAI’s first 1-GW purchase of GPUs. Subsequent tranches vest at specific deployment milestones, with the last tranche vesting only when OpenAI buys all 6 GW.

“Importantly, the vesting of each tranche is directly tied to increasing AMD stock price milestones, with the final tranche vesting at a price of $600 per share,” said Su on the conference call with investors. “And to further align our interests, exercise of the warrants are tied to OpenAI achieving key commercial and technical conditions that are important to ensure the success of their AMD Instinct deployments.” So both companies must meet certain milestones for the deal to mature.

AMD CEO Lisa Su. Source: AMD

The deal’s structure also ensures that AMD and OpenAI will work together to as “core strategic compute partners” to share technical expertise so the goals of both companies are met. “Building the future of AI requires deep collaboration across every layer of the stack,” said Greg Brockman, co-founder and president of OpenAI, in a press release. “Working alongside AMD will allow us to scale to deliver AI tools that benefit people everywhere.”

AMD Scores with OpenAI

The deal with OpenAI is the latest evidence of AMD’s growing presence in the AI chip market. AMD is increasingly catching up to NVIDIA among the hyperscalers, with major deployments by Meta and Microsoft. And several so-called neoclouds have stumped up to buy AMD along with NVIDIA chips, including Crusoe, DigitalOcean, and Runpod. One, TensorWave, has built its network entirely on AMD chips.

All of these large-scale customers are concerned with vendor lock-in, given NVIDIA’s corner on the market. They also worry about NVIDIA’s supply chain issues and the threat of not having the chips they require. (In contrast with those thinking an AI bubble is building, Lisa Su counters: "There is massive demand for AI compute.") OpenAI’s $10-billion agreement with Broadcom to develop its own AI chips also speaks to these concerns.

AMD’s position relative to NVIDIA is revealed in the size of this deal with OpenAI. The startup is buying 6 GWs of GPU power from AMD, compared to 10 GW from NVIDIA and 4.5 GW from Oracle. Clearly, AMD’s influence has risen significantly with the AI startup. Numbers like this could lever AMD into a better position against NVIDIA, which holds over 90% of today’s GPU market.

Interestingly, though, OpenAI’s use of AMD may be focused mainly on inference, not training, which has been the purview of NVIDIA among supercomputer customers. CEO Su said this choice between using its chips for training or inference is up to the customer; the chips do both. But like NVIDIA, she sees the market for inference exceeding that for training.

And she’s confident that this non-exclusive deal gives AMD a boost it deserves. “By choosing AMD Instinct platforms to run their most sophisticated and complex workloads, OpenAI is sending a clear signal that AMD GPUs and our open software stack deliver the performance and TCO required for the most demanding at-scale deployments,” she said.

As of this writing, AMD shares were trading at $209.87, +45.20 (27.45%). NVIDIA shares were trading at $185.82, -1.79 (0.96%).

Futuriom Take: AMD’s multibillion-dollar deal with OpenAI could be the first really well-structured deal OpenAI has made this year. And it opens AMD to a potential boost in the GPU market.