How Will H-1B Visa Changes Impact Tech Firms?

Last week, U.S. President Donald Trump slapped U.S. employers with a $100,000 fee for H-1B visas, effectively shutting off a key source of talent to tech firms in the USA. The executive order, which raised the visa fee from its former range of $2,000 to $5,000 per employee, was paired with a release from the U.S. Department of Labor declaring a “Project Firewall” to investigate H-1B abusers.

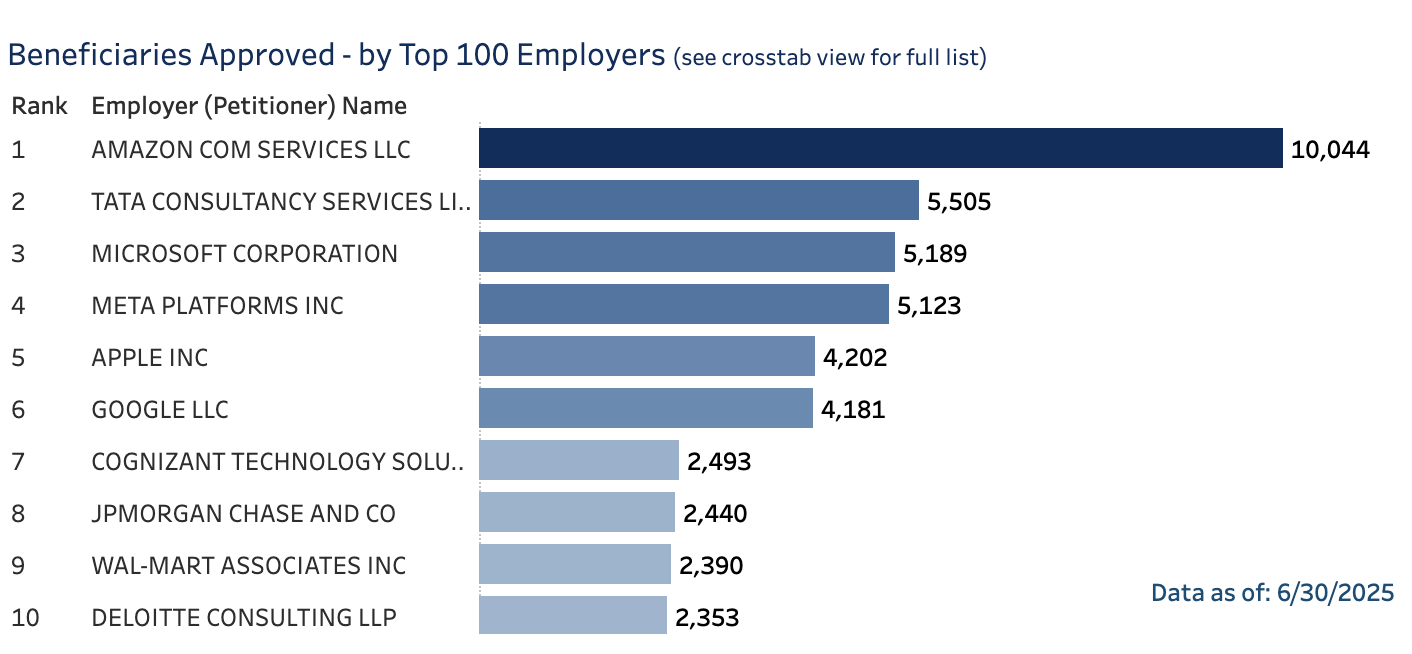

The news has roiled tech firms and their employees. Topping the list is Amazon, which according to data from U.S. Citizenship and Immigration Services (USCIS) approved 10,044 H-1B visa recipients for the year as of June 30, 2025:

Source: USCIS

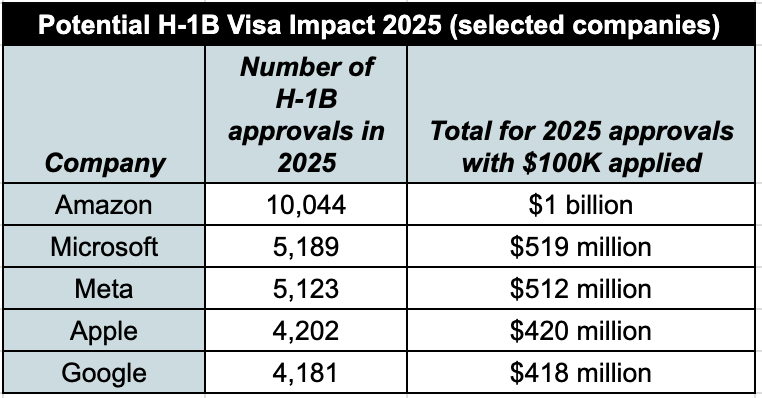

That represents a hypothetical pricetag of over $1 billion for those H-1B staffers. Though the White House has clarified that existing visa holders aren't targeted by the fee, what the rest of the year holds could be mirrored in the first half. By this measure, Microsoft, Meta, Apple, and Google would also have significant exposure, as shown below:

Source: USCIS; Futuriom calculations

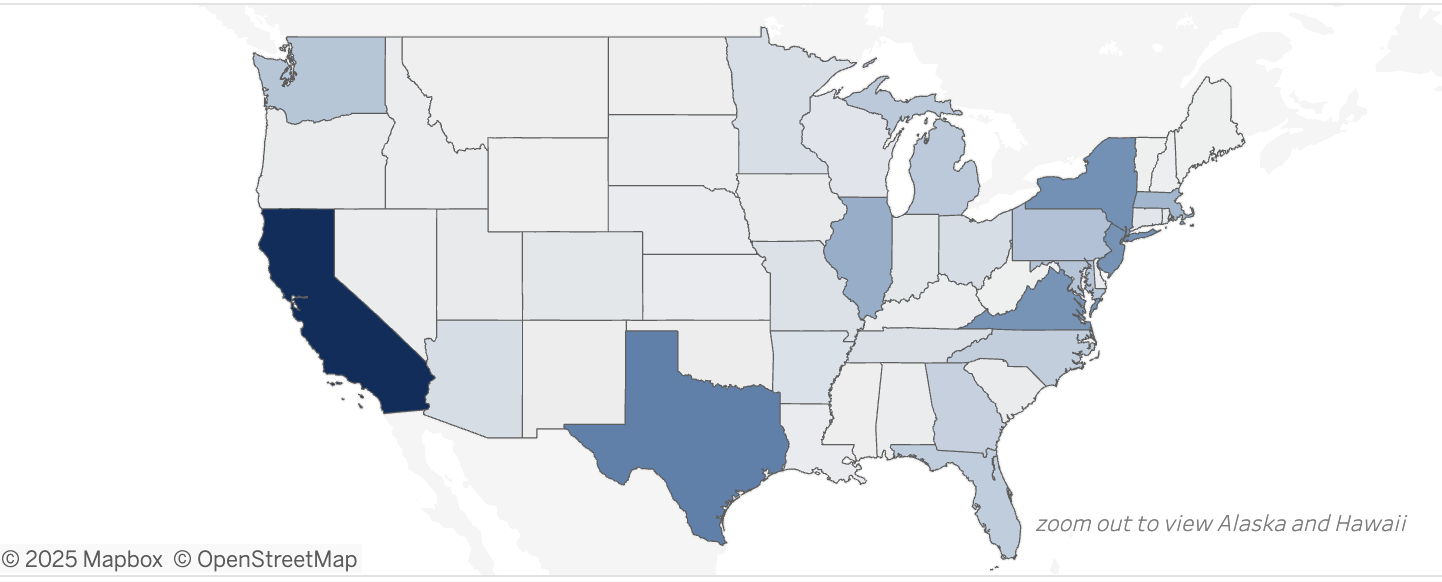

These companies and others will be affected chiefly in California, home to numerous technology companies, but also in Texas, New York, and Virginia (that last state is home to a growing roster of key datacenters for hyperscaler customers). The degree of impact is illustrated by the shading on the map below:

Source: USCIS

The Why: Goal of Reshoring

Among the reasons for the recent executive order are accusations that several top tech companies based in the U.S. have fired American workers in favor of lower-paid foreign ones, while forcing American workers to train their cheaper replacements. This goes against the H-1B requirements that visa’d employees must be hired at salaries comparable to those of American workers and that a foreign employee won’t replace an American one.

Trump says these requirements have been ignored. As proof, his executive order compares recent tech layoff numbers to the numbers of H-1B visas issued. The order states:

“Reports also indicate that many American tech companies have laid off their qualified and highly skilled American workers and simultaneously hired thousands of H-1B workers. One software company [probably Microsoft] was approved for over 5,000 H-1B workers in FY 2025; around the same time, it announced a series of layoffs totaling more than 15,000 employees. Another IT firm [probably Intel] was approved for nearly 1,700 H-1B workers in FY 2025; it announced it was laying off 2,400 American workers in Oregon in July.” [Link and company names added.]

Indian companies such as Wipro and Tech Mahindra also rely on H-1B workers in the U.S. for projects involving workers in both India and America. These kinds of companies are also targeted in the new U.S. executive orderwhich states:

“Using these H 1B-reliant IT outsourcing companies provides significant savings for employers: one study of tech workers showed a 36 percent discount for H-1B ‘entry-level’ positions as compared to full-time, traditional workers. To take advantage of artificially low labor costs incentivized by the program, companies close their IT divisions, fire their American staff, and outsource IT jobs to lower-paid foreign workers.”

Fallout Expected

The new executive order will affect employees from India the most. According to U.S. government data cited by Reuters, as of full year 2024, 283,397 citizens of India held 71% of H-1B visas, followed by China with 46,680 approved recipients (11.7%). Other countries held less than 5% of the visas last year.

Ironically, the clampdown on H-1B visas from India and China comes as U.S. policy has withdrawn funding from American universities, which are essential focal points of AI research. Since Trump's directive specifically cites the need for U.S. college graduates to find STEM employment, the H-1B visa confusion could leave America at a disadvantage compared to other countries, such as China, that are excelling in AI research and expertise.

The endgame for most technology firms could be general confusion in the short term and in the longer term, a focus on reserving H-1B visas for only their top-paid employees. Those hires already account for massive pay packages; some, including software architects with AI training, command $500,000 salaries. Adding a bit more to that probably won’t be a disincentive to keep valuable staffers.

There will also be impact on profits. As some have pointed out, the fresh cost of H-1B visas will move from administrative to major business expenses. Some of these costs, of course, could be balanced by layoffs of H-1B employees, though that could disrupt business as well.

Who Benefits

Significantly, global capability centers (GCCs), or satellite hubs of U.S. firms, can continue to be staffed by regional employees without any need for U.S. visas. In the wake of Trump’s directive, this should give rise to companies relying more heavily on GCCs. "Time zone proximity will accelerate GCCs and resourcing in Canada, Mexico, and Latin America, where talent is stable and cost advantages remain," ISG President and Chief AI officer Steven Hall told Reuters. "GCCs in India will also continue to rise with broader capabilities and skills as enterprises shift strategic roles to India."

At the same time, some experts anticipate that the H-1B requirement will benefit other countries by offering them an influx of talent they otherwise wouldn’t have access to. Europe, for instance, could welcome technology workers shut out of the U.S. market. There are also opportunities in the Middle East, as datacenters and AI hubs continue to grow there.

Futuriom Take: The disruption to technology companies resulting from the latest order from the U.S. White House could be significant, as many struggle to change a long track record of supply and demand in the job arena.