Futuriom's Enterprise AI Index Has Dropped!

The Futuriom Enterprise AI Index Has Dropped!

Futuriom is a data-driven research company. That's why we are constantly building new data resources to tell you what's going on in AI, cloud, and communications infrastructure.

Today we have launched the Enterprise AI Index, which is part of our premium Cloud Tracker Pro service. Cloud Tracker Pro now includes three large relational databases, of which the Enterprise AI Index is the latest to be added to the family. The other two are the Hybrid Cloud Index and the Mobile Services Tracker.

If you haven't subscribed yet (I know you will), let me take a minute to tell you what's in the Enterprise AI Index.

Why We Built the AI Index

Most of the stuff we build because we need it ourselves. Currently, I believe there is a large gap of understanding about information on AI. Most of the stuff you read is about the latest gazillion-dollar deal to build out an AI datacenter. The problem with this is that much of the current focus is on the supply side. We know less about the demand side—how much people are going to use, and why.

There is no doubt that use of Gen AI has gone mainstream—for both consumers and enterprises. But so far, the markets are still quite small and there are questions about whether large AI firms can turn a profit with the huge cost of delivery. For example, OpenAI has $20 billion a year in estimated annual revenue, but it is estimated to be losing billions of dollars a year (the company is private). Let's compare that to hyperscaler MIcrosoft, which has about $300 billion in revenue and $100 billion in annual profit.

For these massive infrastructure investments to pay off, demand must scale to consume the massive supply. And here, enterprise demand will be key.

With the Enterprise AI Index, we wanted to study interesting enterprise AI case studies and collect data about them. So we have built an initial relational database of 150 enterprise AI case studies, and it's growing every week.

This database was built by our team with significant contributions from Senior Analyst Mary Jander and Jr. Data Analyst Juliet Raynovich. Special thanks to Mary and Juliet! Also, I would like to thank our technology consultants and advisors, Kevin Binder and Kanchana Kumara, who act as our virtual tech team.

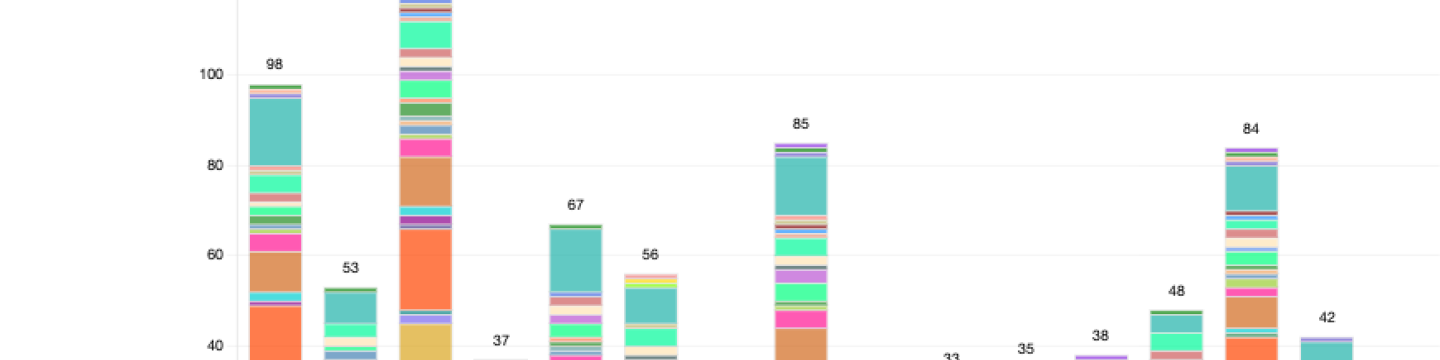

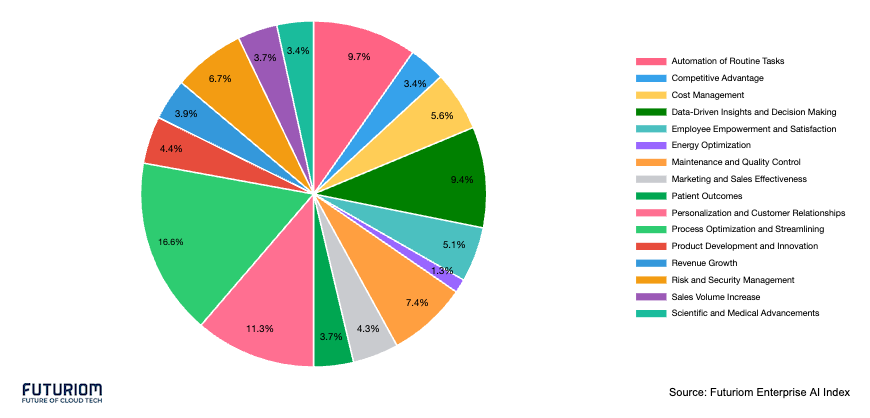

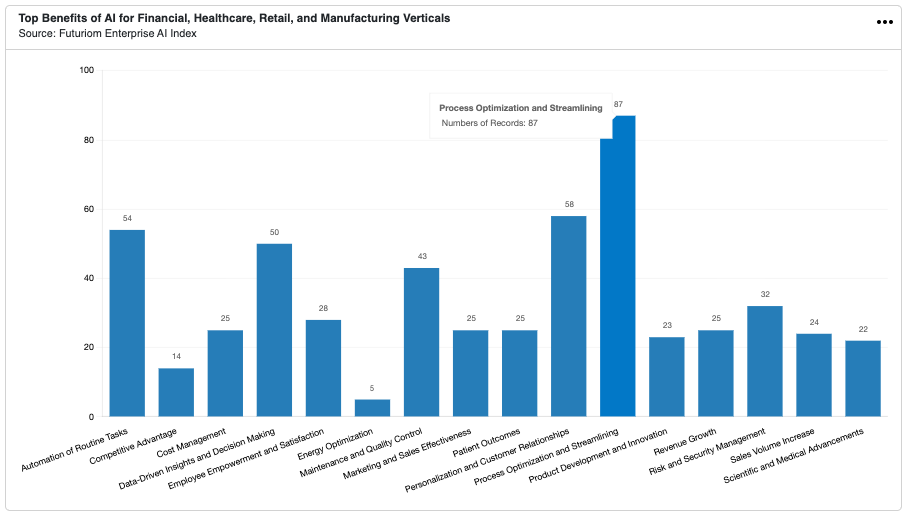

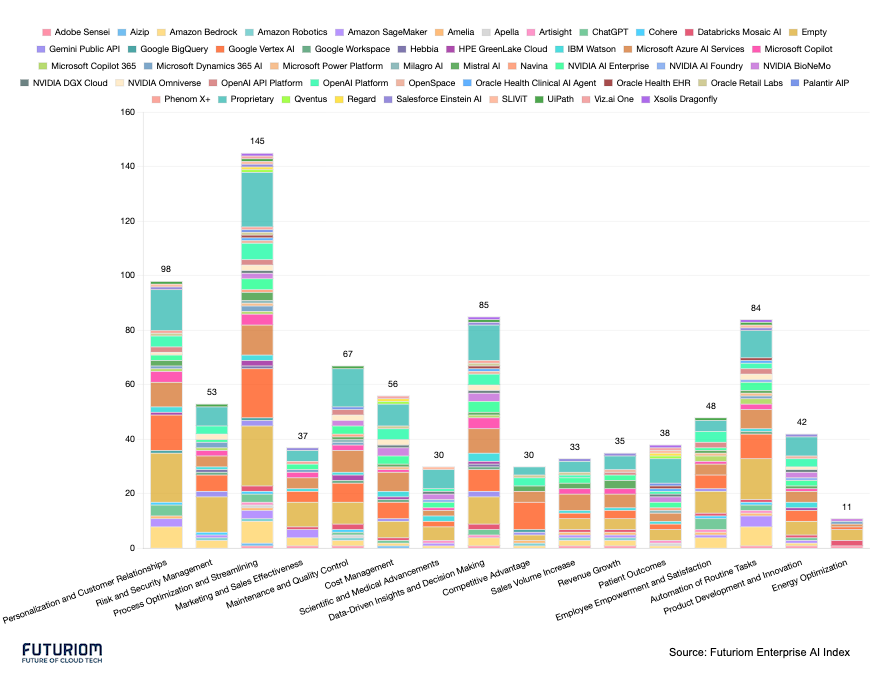

We've also made some significant investments in the technology. We collect some of our data using Airtable, but that's not enough. We have also fed that data into our own relational database, based on open-source technology, which enables us to present visualizations of the data in our own Web interface. This data is dynamic and searchable. Here are some screen captures, including the Top Benefits of AI and the Top Benefits for Selected Financial, Healthcare, Retail, and Manufacturing Verticals:

Top Benefits of AI

If you have a subscription, this data is all clickable and sortable. Subscriptions start at $48 a month for an individual. To me this seems like almost nothing if you are a professional studying the fastest growing market in the world, ;-)

If you are an enterprise, talk to us about how to use this data with an enterprise license. For example, you could leverage the data in presentations, or even work with our analyst team to provide compelling research and content about the market. Subscribers can download charts and presentations, as well as access all of our Cloud Tracker Pro reports.

Early Finding: Proprietary AI Is Taking Off

As I said, we initially built this dataset to understand the market for ourselves, and we're hoping that by sharing it and analyzing it we can better illuminate what's happening in the largest technology cycle in history.

We're finding some interesting things, and we've published some of these findings already, both at the free and subscription level for our readers.

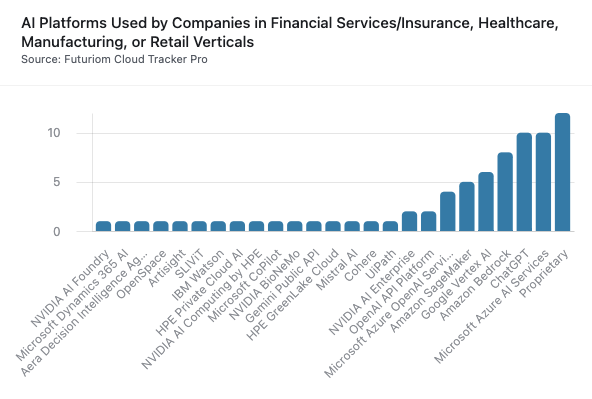

For example, one trend is already clear: Proprietary or private AI platforms are taking off in enterprises. The reasons are clear: They want to own and protect their own data. When you slice by industry, this is especially important in data-sensitive industries such as healthcare and financial services. You can read about this in Mary Jander's blog about why enterprises prefer proprietary AI.

Top AI Platforms by Use Case

How about AI Platforms by use case? Our Enterprise AI Index slices and dices these use cases by platform and industry, all sortable in our relational database. This makes for some very pretty data.

It's clear from our research that the most dominant AI companies, including Amazon, Microsoft, OpenAI, and Google, have huge share in many of these markets. But it's also clear that there is a huge number of specialized models and that proprietary and private AI will play a big role in how enterprises deploy the technology.

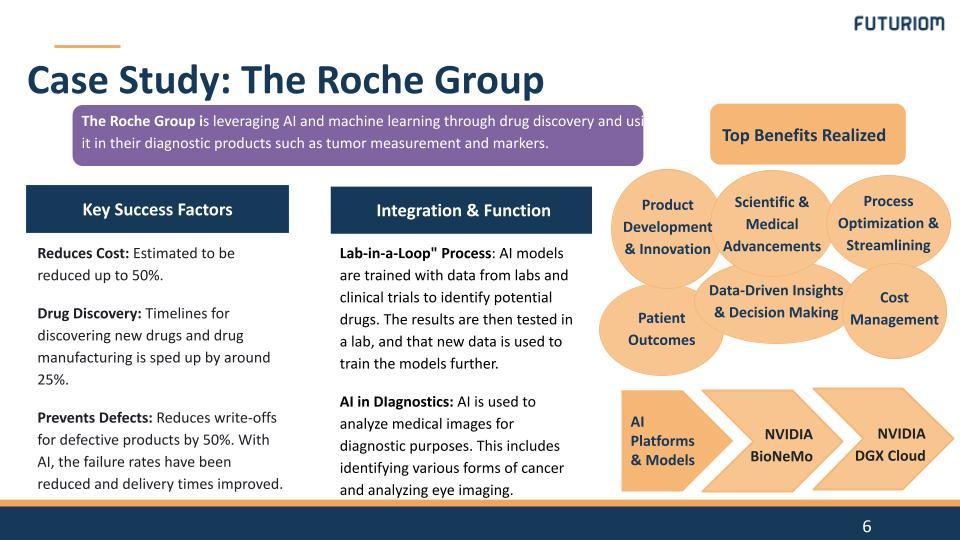

Over time, we'll also publish deep dives on Cloud Tracker Pro where we detail specific use cases and deployment. For example, you can read up on what Roche is doing with AI.

Data and Methodology

We like to provide balanced and truthful information, without an agenda, so we think a lot about our potential data collection process. Let me provide a couple notes about the methodology of our AI Enterprise database.

All data by its nature is biased. When we set out to collect this information, our goal was to educate ourselves and the market with the most balanced approach. We collect information only from public, primary sources: official news releases, financial statements, corporate websites, presentations, and interviews. The case studies are vetted and then selected by us. There is a potential bias in our collection process, but we have focused on prominent firms and brand names that people know, including some of the best companies of the world. We also look to balance the case study collection across industries, to get a broad view of what's happening in the enterprise space.

Nothing's perfect, but we will aim to perfect this. And we'll add a lot more data and analysis over time. With this information, we think we are in a great position to narrate how the enterprise AI journey will unfold over time—and we believe this will be a long and powerful cycle over many years. It's all just getting started.

So dig in, and if you have any questions, feel free to reach out! And thank you to the Futuriom team for making this all happen!