Oracle Shocks Wall Street

Oracle’s future looks so bright, you’ve got to wear shades. Just make sure you can still see clearly through the rose-colored glasses.

That’s the message emerging from yesterday’s Q1 fiscal 2026 earnings call, in which the cloud database giant reported a stunning remaining performance obligation (RPO) of $455 billion, up 359% year-over-year (y/y).

“Clearly, we had an amazing start to the year because Oracle has become the go-to place for AI workloads,” said CEO Safra Catz on the earnings call. “We have signed significant cloud contracts with the who's who of AI, including OpenAI, xAI, Meta, NVIDIA, AMD, and many others.”

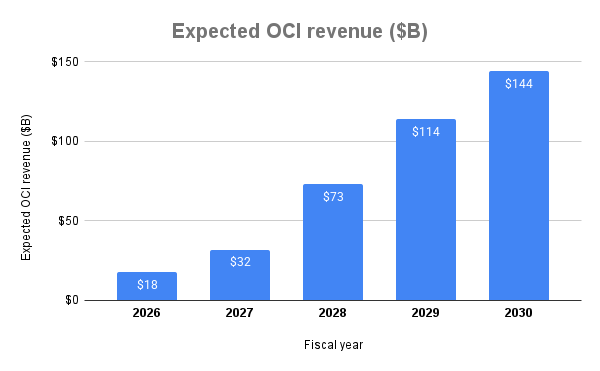

There’s more to come. In the press release, Catz stated: “Over the next few months, we expect to sign-up several additional multi-billion-dollar customers and RPO is likely to exceed half-a-trillion dollars.” She said Oracle Cloud Infrastructure (OCI) revenue is expected to grow 77% to $18 billion this fiscal year, increasing to $144 billion annually in fiscal 2030.

Source: Oracle guidance

Analysts on last night’s earnings call were unabashedly gobsmacked, saying things like: “It’s just amazing,” “I think we're all kind of in shock in a very, very good way,” “It’s an amazing day,” “…momentous quarter,” “Congratulations!”

You wouldn’t guess from all this that Oracle earnings fell short of analyst expectations. Total sales rose 11% to $14.9 billion; the analyst consensus was for $15.04 billion, according to data cited by the Wall Street Journal.

Wall Street was forgiving on that note: As of this writing, the shares were trading at a record high of $335.67, up 39%, in a rally that has turned co-founder, chairman, and CTO Larry Ellison into the world’s richest man.

What’s Hot and What’s Not

Oracle’s earnings showcased its cloud offerings, for which sales rose 28% y/y to $7.186 billion. Growth was particularly strong in sales of Oracle products within the public cloud services: “MultiCloud database revenue from Amazon, Google and Microsoft grew at the incredible rate of 1,529% in Q1,” stated Ellison in the press release. “We expect MultiCloud revenue to grow substantially every quarter for several years as we deliver another 37 datacenters to our three hyperscaler partners, for a total of 71.”

In contrast with cloud, software sales were down 1% to $5.721 billion. Still, that number was overshadowed by the monumental predictions for OCI, driven by hyperscaler support as well as by demand for private AI clouds and sovereign services, areas where Oracle sees itself outstripping its hyperscaler partners. Here’s how Ellison put it on the earnings call:

“We have large companies that are buying basically their own Oracle Cloud regions, in fact, multiple Oracle Cloud regions, because they don't want to have any neighbors in their cloud. They don't want other companies in their cloud. They want the full cloud…. They want us to buy and own the software and the hardware. They want us to maintain it, build the networks, supply all of that, and they just want a pay-per-consumption. We can do that at an entry-level price that's 1% of what our competitors can offer.”

One tool in Oracle’s arsenal is the Oracle AI Database, a cloud service that lets customers run AI models such as Google’s Gemini, OpenAI’s ChatGPT, and xAI’s Grok directly from their own Oracle data, a step that should help enterprises to advance their AI inferencing efforts.

Indeed, inferencing, the process in which enterprises adapt AI models to fit their specific data, loomed large in last night's earnings call. “[T]he AI inferencing market will be much, much larger than the AI training market.... It’s AI inferencing that will change everything," said Ellison.

Can Oracle Keep Up?

Despite all the hoopla over last night’s earnings, a lot of Oracle’s future depends on the company delivering the infrastructure on which its services run, which means facing challenges in datacenter buildouts, including power supply issues and availability of chips from NVIDIA, whose supply chain problems persist.

Power is perhaps the biggest problem. While the current U.S. government is encouraging enormous datacenter buildouts, such as the Stargate project that includes Oracle, SoftBank, and OpenAI, the utility companies are struggling to keep up with the massive power demanded by AI datacenters. This is leading to arguments over who will foot the bill for significant grid upgrades, and how those upgrades will be implemented. The current U.S. administration’s resistance to renewable energy has turned attention to nuclear reactors, which still rely on limited uranium resources.

Still, there are signs that the momentum behind AI is building, which could force changes. Futuriom research on over 150 enterprises worldwide reveals a solid movement toward incorporating AI into multiple operations across leading vertical markets. (Keep an eye out for our Enterprise AI Index, which will be officially launched in the next two weeks.)

As this momentum builds, Oracle will likely become a force for innovations such as the development of alternative datacenter cooling technologies and non-NVIDIA GPUs. The future will determine whether Oracle is a bellwether or a prophet of disappointment.

Futuriom Take: Oracle blew Wall Street away with last night’s declaration of a massive backlog for its AI-based services. Now Oracle must make good on its promises, something that could pit the company against a range of environmental challenges and expose it to looming GPU shortages. In the process, Oracle could become a major catalyst for development of solutions to these problems.