Enterprise AI Profile: How GEICO Uses AI

Futuriom Enterprise AI Profile

Organization: GEICO

Vertical Industry: Financial Services and Insurance

Description: Berkshire Hathaway subsidiary GEICO sells vehicle insurance of all kinds throughout the U.S. For years, the company has deployed AI to streamline customer service, claims management, and fraud detection. By identifying these challenges early and deciding to implement AI to make improvements, GEICO has been able to realize operational efficiencies, increase profitability, and maintain a leading position in the insurance market.

As noted, one of GEICO’s first applications of AI was in customer service, where GEICO saw delays in getting questions answered and problems resolved. In 2017, the company introduced a chatbot that uses machine learning and natural language processing to answer questions about the insurance industry, insurance products, and GEICO as a company. The GEICO AI Virtual Assistant, implemented in GEICO’s mobile app, can help customers make payments, get quotes, get proof of coverage, and manage drivers. It also links them to live agents as needed to help with policies and claims. GEICO has indicated that it's used its own neural networking model to produce its Virtual Assistant.

GEICO also needed help with evaluating accident reports for claims. In 2021, It deployed machine vision and AI from Tractable, a company headquartered in London, UK, to analyze photographs of vehicle damage to determine what can be repaired—or not. Tractable’s AI uses a system of triage based on photo analysis to determine the severity of damage to a vehicle after an accident, which cuts time in the claims process.

To further speed claims, GEICO also has enlisted a vendor named CCC Intelligent Solutions, a Chicago-based SaaS provider whose Smart Red Flag with Cross Carrier Analysis can identify fraudulent activity, such as making the same claim to multiple insurance providers. GEICO also uses CCC’s Estimate Share capability to allow multiple facilities to coordinate repairs to damaged vehicles. Notably, CCC and Tractable, both deployed by GEICO, have had legal disagreements caused by their overlapping capabilities but settled a suit earlier this year.

GEICO uses AI in many other ways throughout its infrastructure. “This is not a new space,” said Rebecca Weekly, VP of Infrastructure at GEICO, in an interview with AMD TechTalk host Jim Greene last year. She said GEICO has relied for many years on AI-driven automation and machine learning to keep IT equipment functional.

That said, rumors and speculation abound about particular products the firm has used to enable AI-infused analytics and automation on the front and back ends. But the company is cagey about confirming its use of specific products and vendors. And open source, including DataHub, OpenStack, Flutter, and Kubernetes, seems to be a favored approach. Further, the insurer has reportedly been overhauling its IT environment to accommodate new applications and the enormous volumes of data the company deals with. This includes repatriating many applications, including AI ones, from what was said to be in part an Azure environment.

Despite the complexities involved, “It’s not rocket science what we’re doing,” said Weekly in the Greene interview. “We’re trying to make sure that our flow for doing rate-to-risk model analysis, serving our customers in their claims, serving our customers when they ask for policies, is fast and unified across our lines of business.”

AI Platforms and Models Used: Proprietary models, much open-source technology, and a variety of unverified third-party tools.

Key Success Factors: GEICO has been able to reduce losses and increase the overall speed of processing claims. For example, an often-quoted observation is that GEICO posted a $1.9 billion underwriting loss in 2022 but a $3.6 billion profit in 2023, after deploying AI to streamline its claims process. Parent company Berkshire Hathaway credited GEICO’s improved operating efficiencies in part for the improvement in a December 31, 2024, SEC filing, which stated: "Earnings in 2024 and 2023 benefited from significantly improved operating results at GEICO, which generated a significant loss in 2022." GEICO has also enjoyed competitive advantage by moving to AI before some of its rivals.

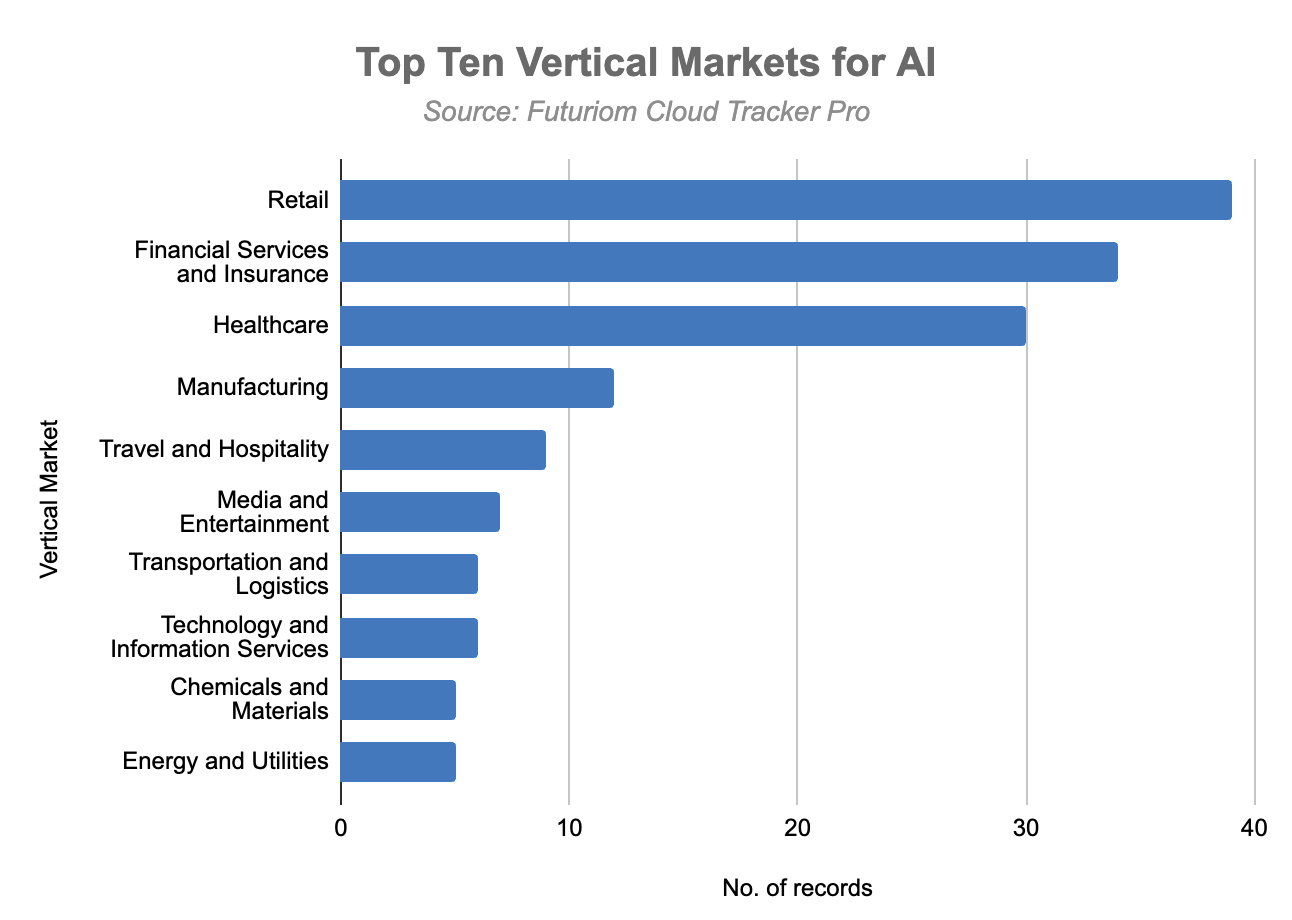

Note: According to Futuriom’s Enterprise AI Index data, GEICO is part of the second-largest vertical market represented in our database: