Fears Grow About OpenAI Deals with NVIDIA, Oracle

This week's arrangement between NVIDIA and OpenAI lays bare the circular economies that have been building up AI. So far there have been no legal or regulatory issues, but it looks uncomfortable from the outside, as it helps drive up stock prices with increasingly speculative promises.

We may now be deeper into bubble territory, with Oracle's stock multiple exceeding NVIDIA's. That's nuts, as DA Davidson analyst Gil Luria pointed out on CNBC. More on that in a bit.

The NVIDIA-OpenAI agreement—which so far is only a letter of intent and not a signed deal—has NVIDIA investing up to $100 billion in OpenAI, distributed based on infrastructure milestones. OpenAI will use at least some of that money to buy NVIDIA chips. Reuters quoted one source saying that once the deal is in place, OpenAI's first NVIDIA purchase would be for Vera Rubin systems to be delivered in late 2026.

This isn't the first such deal NVIDIA has participated in; it's drawn similar circles with CoreWeave and Lambda. But it seems particularly brazen given how much of the AI economy seems to depend on OpenAI.

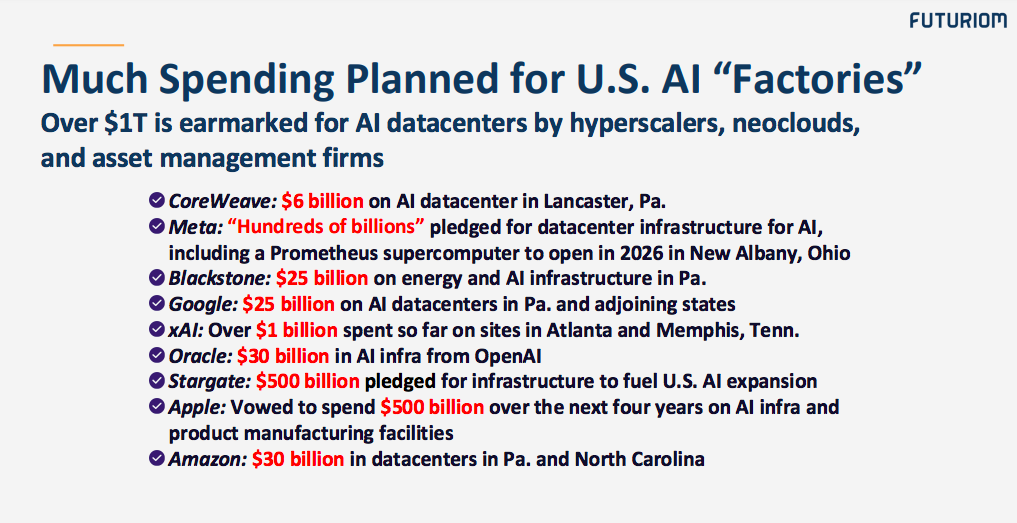

As we noted in a recent Cloud Tracker Pro report, more than $1 trillion has been pledged for AI datacenters, with most of it related to OpenAI. Oracle, notably, plans to spend $30 billion for OpenAI's sake. Oracle's stock accordingly rose after the NVIDIA announcement.

The Money Question: Growing Debt?

The biggest question to ask is: Where will the money come from? OpenAI has pledged hundreds of billions of dollars for new datacenters. But it doesn't yet have that money— so far it's unprofitable, and it's made public statements that it may not be profitable until 2029. It's been estimated that it might crack $20 billion a year in revenue. So its pledged investment in NVIDIA kit far exceed its revenues and balance sheet, and it's going to have to raise that promised money with debt or equity financing.

This is a big shift in the AI market. Previously, the rationalists of the massive AI buildouts pointed out that the money was coming from large profitable hyperscalers, with funding from their enormous cash flows. A shift to primarily debt financing would be a big change.

To build out all those datacenters, companies such as CoreWeave are raising debt. But debt for CoreWeave isn't the same as debt for, say, Microsoft—a company with an established franchise and massive flows of revenue, as Luria pointed on CNBC Wednesday.

The likes of Microsoft and Amazon can raise debt at rates around 5% and will likely see double-digit returns on it. The "incrementals" such as CoreWeave (Luria's term), are borrowing at more like 10% to 12%, and are looking at single-digit returns, he said.

He counted Oracle as an incremental too. Oracle is a veteran tech company, of course, but it's new to the infrastructure world, where margins won't be the same as for databases.

Luria is especially fraught that Oracle, having risen about 30% this month, has a price-to-earnings multiple (roughly 70) higher than that of NVIDIA (50). Even though NVIDIA is "overstimulating" the market, its path to success in AI is guaranteed. Oracle, providing the harder-lift datacenter end of all this, seems less of a certain bet.

Bottomless Spending

Meanwhile, The Information recently reported that OpenAI spent $2 billion during the last two years and is projecting to burn through $115 billion between this year and 2029. That rate of spending is fueling AI activity in multiple directions including investments, debts, and construction.

It's difficult to believe this will last forever. Oracle's stock price, NVIDIA's financing of customers, and OpenAI's bottomless spending—it's all familiar to anyone who lived through the dotcom era and the telecom fiber bubble.

That doesn't mean the AI era is fiction. It's just difficult to buy into theory that the manic datacenter expansions of the past few years will be necessary ad infinitum. These kinds of bubbles collapse, even if the end goal is valid—plenty of people have likened the AI surge to the initial dotcom boom. The numbers are bigger this time and pegged heavily on one company, OpenAI. NVIDIA will come out OK, but a bubble pop will be ugly for most others.