Enterprise AI Profile: Mastercard Tackles Fraud and Productivity

Enterprise AI Profile: Mastercard

Organization: Mastercard

Vertical Industry: Financial Services and Insurance

Description: Mastercard, a global leader in technology and payment networks with an estimated 3.158 billion cards in circulation worldwide, has made a major commitment to artificial intelligence (AI) to identify and resolve key challenges across its ecosystem. Leveraging generative AI to expand its global payments network, Mastercard is focusing its AI efforts on three core areas: security and fraud prevention, personalization, and productivity.

AI plays a crucial role in Mastercard’s operations, from detecting fraud and network anomalies to enhancing customer experiences and increasing the efficiency and success rate of transactions. As of December 2024, Mastercard employed approximately 35,300 people, and its AI expansion is designed to augment employee expertise rather than replace it.

According to Ed McLaughlin, Chief Technology Officer at Mastercard, AI is being integrated into every aspect of the company’s work. He emphasizes that it’s about fostering effective human-computer collaboration, not job elimination. “There’s so much more work to be done and creativity to unlock,” McLaughlin notes, “and by harnessing the power of AI, we can use these systems to handle repetitive tasks and free humans to focus on innovation.” Mastercard has made a strong commitment to supporting its employees through this transformation. The company invests equally in employee development and technology, ensuring that for every dollar spent on new tools or AI licensing, an equivalent investment goes toward training and support programs.

Mastercard’s AI-driven innovations are already active. Safety Net, for instance, acts as a circuit breaker to stop large-scale fraud incidents far faster than any human operator could. The company also provides Fraud Insights, offering real-time analytics and trend identification to prevent future attacks. These tools operate under the umbrella of Brighterion, Mastercard’s AI-powered Decision Management Platform, which delivers progressive intelligence and adheres to Mastercard’s principle that "the only AI is responsible AI.”

Mastercard’s approach ensures that AI enhances both operational excellence and customer trust. Every new AI model is reviewed by an AI Review Board to confirm the project’s purpose and ethical compliance, followed by a technical review to ensure cost-effectiveness and performance. By maintaining a commitment to privacy, safety, and transparency, Mastercard continues to strengthen its reputation.

AI Platforms and Models Used: OpenAI's ChatGPT (for Agentic Commerce); Brighterion Decision Management Platform (proprietary); Proprietary models (including recurrent neural networks for fraud).

Key Success Factors: Mastercard’s primary optimization goal is to ensure that legitimate transactions are approved—resulting in an 85% reduction in incorrectly declined cards. Improvements in fraud detection powered by the company’s newest Generative AI systems have prevented more than $2 billion in fraudulent activity within a 12-month period. By implementing recurrent neural network (RNN) techniques, Mastercard achieved a 20% overall improvement in fraud detection and up to a 300% improvement in specific sectors where traditional machine learning methods were less effective.

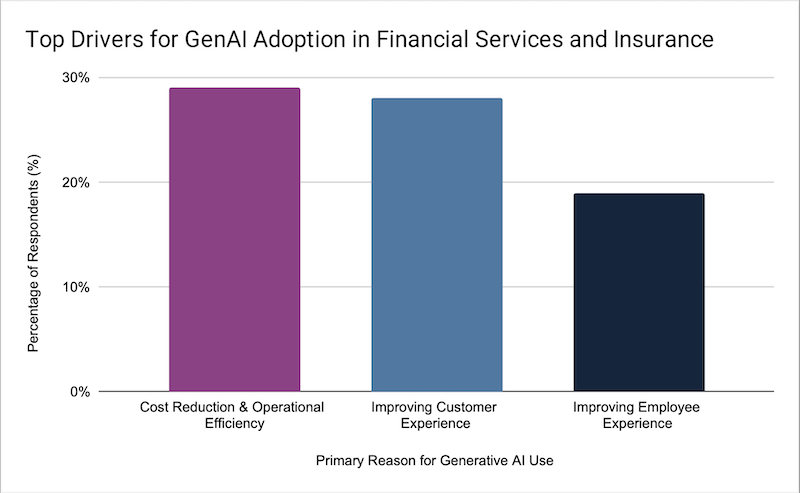

Note: The data in this chart was sourced from a global survey of 509 financial technology and operations leaders conducted by Broadridge Financial Solutions Inc. (December 2024–January 2025).

Futuriom Take: As a primary leader in credit and debit payment processing, Mastercard's rigorous and regular use of AI, establishes a competitive advantage. This strategic commitment to AI will likely compel other financial institutions to adopt similar forms of AI integration to remain competitive in the global payments and financial technology sphere.