What's the Status of Hyperscaler Infrastructure?

While AWS, Google, Microsoft, and Oracle have broadcast enormous capital spending on projects to extend their cloud infrastructure, new facilities aren’t yet showing in their live networks. Further, it’s worth questioning just what these new datacenters will do once they come online. Let’s take a look.

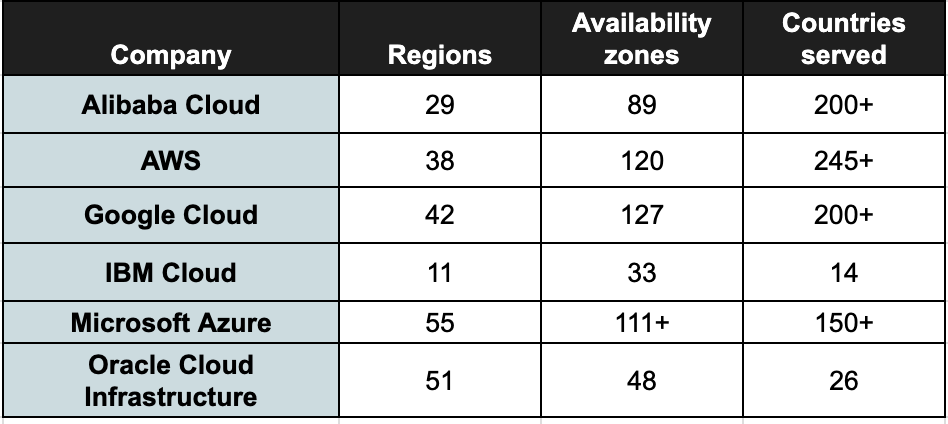

To check out what the cloud vendors are doing, it’s helpful to review their current infrastructure. For context, hyperscaler networks are generally described in terms of worldwide regions and availability zones. Regions are geographic locations in which services are available. A country may have one or multiple regions within it, though a region typically spans just one country. Availability zones are networked datacenters within a region. Availability zones can be one or more physical datacenters, or datacenters within which virtual resources comprise availability zones.

Though the cloud vendors differ in the fine points, it’s possible to assemble a general picture of their infrastructure by counting regions, availability zones, and countries served, as in the chart below:

Source: Company reports

To access the rest of this article, you need a Futuriom CLOUD TRACKER PRO subscription — see below.

Access CLOUD TRACKER PRO

|

CLOUD TRACKER PRO Subscribers — Sign In |