Are Hyperscalers Spending Too Much on Datacenters?

Are the cloud hyperscalers spending too much on AI datacenters?

That’s the question prompted by recent earnings reports, which showed capex at unprecedented levels for most of the world’s leading public cloud providers. The answer? While it looks like things are holding steady for now, spending could pressure future profitability. Let’s take a closer look.

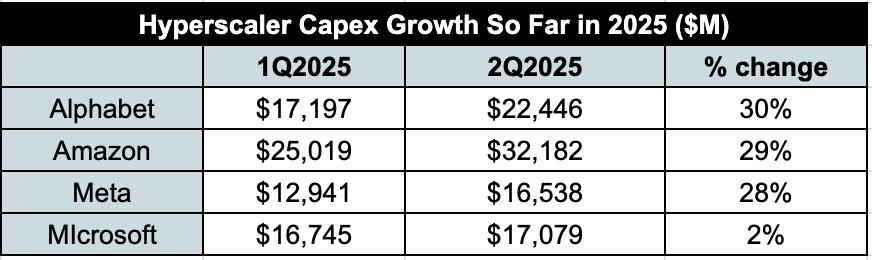

Between the first and second quarters of 2025, three of the four leading hyperscalers substantially increased their capital spending (capex): Alphabet by 30%, Amazon by 29%, and Meta by 28%. Only Microsoft held steady, increasing its quarterly capex by just 2% between Q1 and Q2 of this year.

Source: Company reports

To access the rest of this article, you need a Futuriom CLOUD TRACKER PRO subscription — see below.

Access CLOUD TRACKER PRO

|

CLOUD TRACKER PRO Subscribers — Sign In |

Related Articles

Oracle's latest quarterly report had investors fawning with congratulations over a backlog of contracts. Now it must deliver

The AI datacenter provider has become and investment darling, but debt is piling up

Some hyperscalers have shifted well beyond total reliance on NVIDIA with chips that are powering their AI infra services