Nokia Strategy Update Points to Hidden Strengths

It marked the end of an era for Nokia Oyj (NOK) last week when CEO Pekka Lundmark outlined the company’s plan to regain its market footing after a series of stumbles over the last several years.

Lundmark, who replaced Rajeev Suri as CEO in August, detailed Nokia’s restructuring of divisions and leadership in a strategy that takes effect January 1, 2021. The goal is to put Nokia in at least a number-two spot wherever it competes. “We will only play where we see value creation for shareholders,” said Lundmark.

Of course, this begs many questions about where Nokia is positioned to win and lose as it joins Cisco (CSCO) and IBM (IBM) among tech behemoths struggling to establish solid footing in a shape-shifting market.

Nokia’s Surprise Strengths

By now, the basics of Nokia’s struggles are well documented: Focused on absorbing its $16.6 billion acquisition of Alcatel-Lucent in 2016, the company was unprepared when 5G demand started to build. It fell behind competitors Ericsson and Samsung in developing 5G components and backtracked on silicon designs, cutting its profitability. By October 2019, Nokia ceased to pay a shareholder dividend. A year later, a devastating Verizon contract loss to Samsung coincided with a spate of fresh executive exits as the top-to-bottom restructuring plan unfolded under Lundmark’s leadership.

Despite all this, last week’s update was grounded and encouraging, if insufficiently clear for many investors. And paired with the latest earnings report, it revealed a few hidden gems of particular interest to Nokia’s future. Following, in no particular order, are a few of those bright spots:

Mobile Networks is cut free and charging hard. According to CEO Lundmark, 5G is central to the company’s strategy. Now in its own Mobile Networks division headed by Nokia veteran Tommi Uitto, the group should be better able to focus on gaining some of the ground lost in 5G. “[W]e have decided that we will invest whatever it takes to win in 5G,” said Lundmark in prepared remarks for Nokia’s Q3 earnings report. Part of that commitment will be significant spending on R&D, which will leave no operating margin for mobile next year but should accelerate 5G by 2022.

There’s momentum in 5G components. Reflecting Nokia’s pivot from its early stall in 5G chips, the company is devoting significant resources to accelerating the journey from field-programmable gate array (FPGA) 5G components to full reliance on proprietary ReefShark system-on-a-chip (SOC) silicon in 2022.

Private wireless is on the rise. Nokia sales of private wireless solutions for enterprise customers in utilities and government rose 15% in Q3. This resonates with internal and external research that shows Nokia as the #1 leader in software and services for private wireless deployments. It also tallies with executives’ aim -- also expressed during last week's presentation -- to reach deeper into the enterprise market.

Routing remains strong. Nokia’s routing portfolio (which includes Nuage Networks’ software-defined wide-area networking (SD-WAN), has historically been a solid seller, giving the company a #2 market position (excluding China). While routing sales of €696 million in Q3 were modest — down 3% year-over-year, though up 2% in constant currency — analysts believe the future looks good. In a mid-year 2020 note, Simon Leopold and colleagues at Raymond James stated:

Nokia’s IP Routing remains a bright area on the company’s portfolio. Besides the potential to continue to outperform and outgrow its market, this business unit remains highly profitable, with gross margin well above Nokia’s corporate average. Nokia’s routing business is highly levered to the Service Providers vertical, and the company generates approximately 91% of its sales from this vertical.

Optical networking shines. Nokia’s optical networking segment, which showed €463 million in sales last quarter, outpaced all other network areas, showing 19% growth year-over-year, 24% in constant currency. And on last week’s call, CEO Lundmark predicted the segment would continue to perform well, given that carriers will need optical connectivity at key positions in the 5G environment.

On the downside, Basil Alwan and Sri Reddy, co-presidents of Nokia’s IP/Optical division, resigned in November. Their stature in the industry led to tongue-wagging about their departure and where they might turn up next. Meanwhile, as of January 2021, optical will join the Network Infrastructure division headed by Federico Guillén, who previously was head of customer operations for EMEA and APAC.

Nokia says its optical division occupies fourth place in the competitive worldwide optical networking market, which may point to a risk of it being sold. Still, given its present state as a €1 billion-plus line of business, that could be a lucrative alternative.

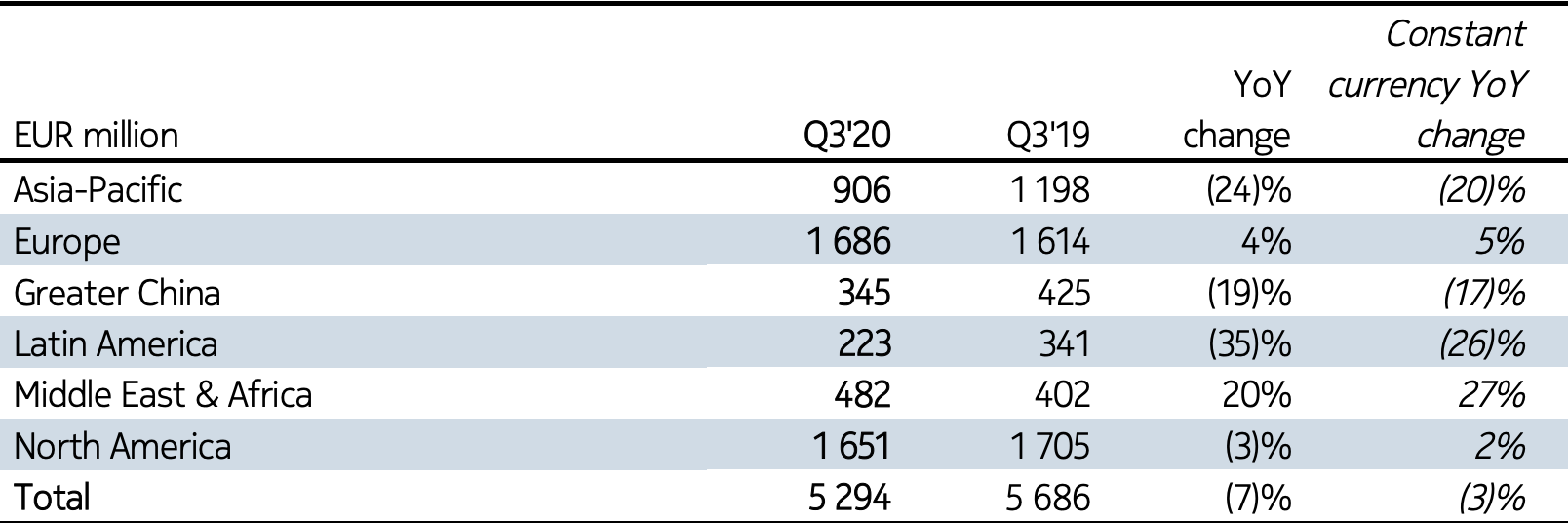

Solid Sales in the Middle East and Africa. While comprising just 9% of sales, this segment grew the most in Q3, bringing in €482 million, up 20% year-over-year and 27% in constant currency. In contrast, sales elsewhere were down or up just slightly, as shown in the chart below:

Considering that the MIddle East has adopted 5G faster than other geographies, and that Nokia’s rival Ericsson has seen sales droop in the segment (down 9% in Q3), it may be time for a closer look at opportunities there.

No Easy Fixes

These and other Nokia strengths are no guarantee the company's restructuring project will succeed. Problems with planning and execution remain, and substantial changes and exodus of talent are likely a headwind.

But Nokia has met challenges in the past. “Nokia has repeatedly succeeded at re-invention,” stated Raymond James analysts in their note. Hopefully, the company can do it again this time.

Nokia has scheduled its Q4 earnings report for February 4, 2021, and its Capital Markets Day March 18.