How Oracle's Crashing the Hyperscalers' Party

Oracle Corp. (NYSE: ORCL) has come to be listed as fourth behind the top three public cloud providers, or hyperscalers (AWS, Microsoft Azure, and Google Cloud). So its worth examining how it’s managed to gain that market share and how it sees the future of cloud services.

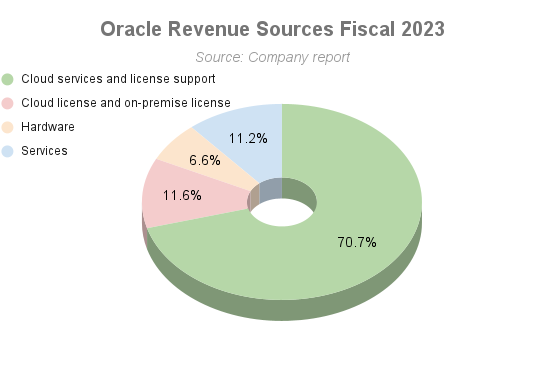

Oracle’s cloud business has grown over 200% since 2018, when the company began reporting "cloud services and license support" as a revenue line item. In fiscal 2018, that revenue was $26 billion, or 66% of total revenues. At the close of Oracle’s fiscal 2023, that number was $35 billion, or 71% of total sales, as illustrated below. (Note that cloud services and license support include Oracle SaaS and Oracle Cloud Infrastructure [OCI]).

"Imagine, just three years ago, OCI was rarely, if ever, mentioned as a viable hyperscale alternative," said Oracle CEO Safra Katz on the company's latest earnings call. "Of course, we knew what we had built and we kept talking about it, and we knew it was only a matter of time."

Comparisons to Rivals

Oracle’s growth is also apparent compared to that of its rivals. Here, however, some caveats apply: First, Oracle’s financial reporting schedule doesn’t match those of other players, which typically report on quarters corresponding to those of the calendar year. Instead, Oracle’s fiscal year ends on May 31, and the next year begins June 1. This makes apples-to-apples comparisons difficult. Still, we’ve incorporated Oracle’s reported fiscal years against the calendar years of other players in an effort at estimated comparisons.

To access the rest of this article, you need a Futuriom CLOUD TRACKER PRO subscription — see below.

Access CLOUD TRACKER PRO

|

CLOUD TRACKER PRO Subscribers — Sign In |