The Datacenter Liquid Cooling Market Heats Up

As AI spawns bigger and denser datacenters, concerns over cooling GPUs and other infrastructure are taking the spotlight, with liquid cooling a logical next step. It’s easy to see why: Power consumption per rack is growing exponentially, and computer room air conditioning (CRAC) consumes too much power to keep up.

NVIDIA’s Kyber rack, for instance, designed to run 576 Rubin Ultra GPUs and due to arrive in 2027, will require 600 kW of power initially—enough to power over 100 homes. Later designs will scale to 1 MW per rack.

All that wattage gives off heat, which reduces the power usage effectiveness (PUE) of the average datacenter. According to JLL Research, a division of the global commercial real estate and investment management company, traditional CRAC loses its efficiency and cost optimization at roughly 50 kW.

Direct-to-Chip Cooling Takes Center Stage

There are a variety of liquid cooling technologies on the market, and vendors are moving quickly to create even more. But direct-to-chip cooling is presently the fastest-growing segment of the liquid cooling market. In this approach, a plate containing water, water-plus-glycol, or dielectric fluid (which doesn’t conduct electricity) is mounted onto the surface of the CPU or GPU to draw off heat, which is either removed from the liquid (single-phase) or evaporated and recondensed into liquid (two-phase) before the liquid recirculates through the cold plate.

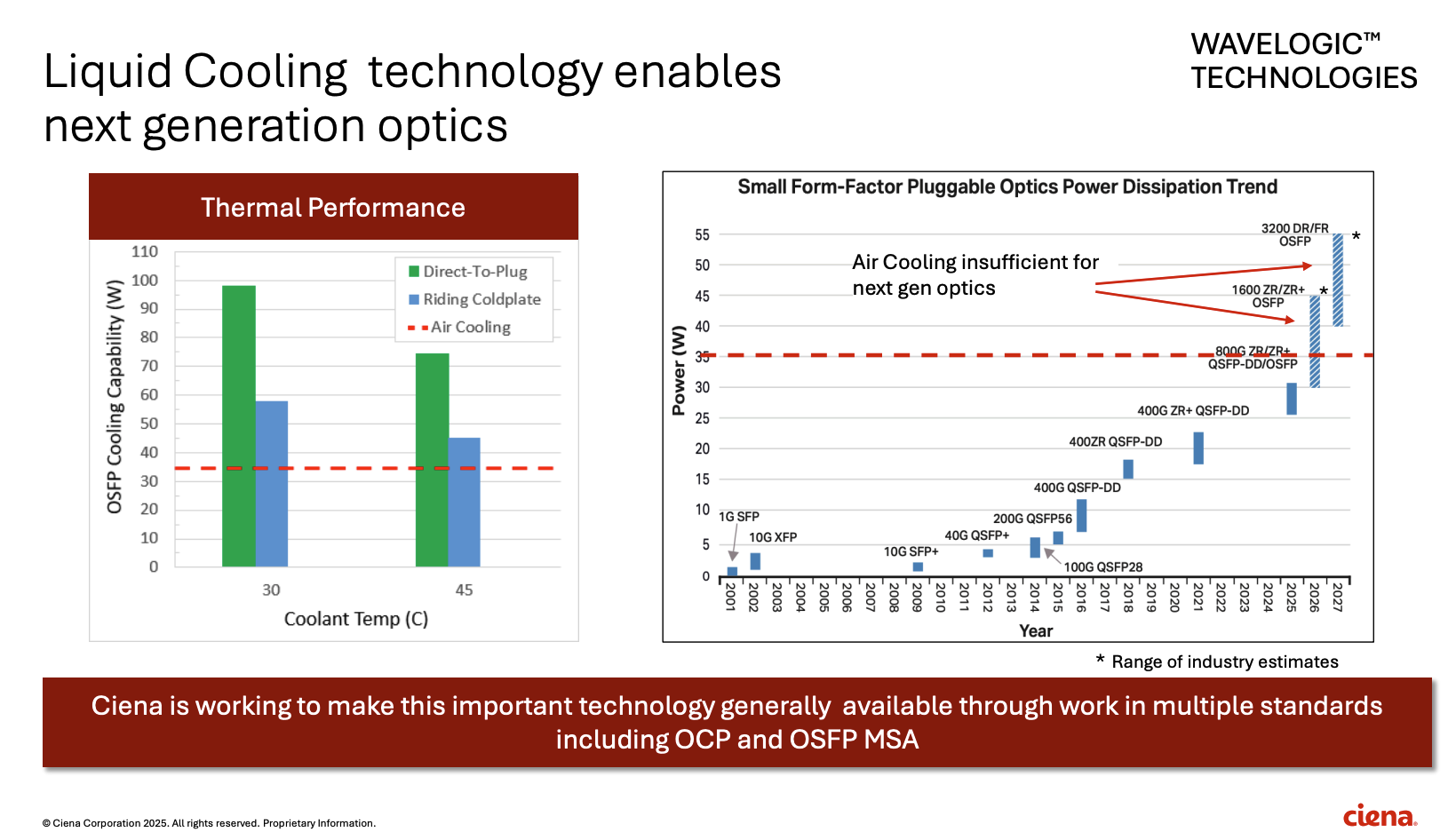

Innovations in this area are on the rise. Optical connectivity provider Ciena, for instance, has created a technique for cooling high-speed pluggable optical components for use in datacenter interconnect (DCI), metro, and long-haul networks by a "direct to plug" technique that eliminates the need to house the pluggable optical component in an exterior cold-plate housing that formerly "rode" or slid over the pluggable.

Ciena says this technique, which it is working to standardize with the OSFP MSA and to contribute to the Open Compute Project (OCP, see Ciena's recent presentation there here), ensures effective liquid cooling as pluggables reach higher bandwidths and rack densities, as shown in the chart below:

Source: Ciena. Used with permission.

Other companies are also implementing their own take on DTC cooling. Amazon CEO Andy Jassy recently summarized the cloud provider's water-cooled DTC solution on LinkedIn. Called an In-Row Heat Exchanger (IRHX), the system appears to address groups of chips with direct-to-chip water cooling. Jassy wrote:

"Our IRHX can support a wide range of racks requiring liquid cooling, uses 9% less water than fully-air cooled sites, and offers a 20% improvement in power efficiency compared to off-the-shelf solutions. And because we invented it in-house, we can deploy it within months in any of our data centers, creating a flexible foundation to serve our customers for decades to come."

Other Liquid Cooling Techniques

Two more technologies are notable in the liquid cooling market:

Rear-door heat exchange (RDHx): This liquid cooling method runs water or other liquids through pipes or plates located at the back of an equipment rack, cooling the hot air leaving the rack before the heat can enter the outside datacenter. RDHx can reduce the amount of CRAC required in high-performance datacenters. Passive RDHx systems rely on a server's fan to move hot air into the heat exchanger, where chilled water or other fluid cools the air. Active RDHx systems deploy their own fans to move air into the heat exchanger.

Immersion cooling. In this option, entire servers are placed in heavy tanks holding dielectric fluid. In single-phase immersion cooling, the fluid is passed through pipes alongside cooling water and rerouted to the tank. In two-phase immersion cooling, fluid is chosen for its low boiling point, and contact with the hot datacenter gear turns it to gas, which is then cooled by a condenser and returned to a liquid state to be rerouted through the system.

Fitting the Cooling to the Rack

Each type of liquid cooling is suited to specific volumes of power required by datacenter systems. Traditional IT racks consume under 25 kW of power as of this writing, though AI and HPC racks can draw 60 kW to 120 kW, depending on configuration. Hence, we're still seeing a large proportion of DTC and RDHx systems, and hybrids, with immersion cooling still less prolific. A chart from JLL Research illustrates the anticipated progression in use of liquid cooled technologies:

Source: JLL 2025 Global Data Center Outlook. Used with permission.

Market Trends

Liquid cooling techniques differ in cost, complexity, PUE, and availability. Presently, DTC and RDHx are most popular, with immersion cooling following, though problems involving tank weight make that last option still a work in progress.

Further, the market for two-phase DTC and immersion cooling is newer than that for single-phase versions but is expected to grow faster, as two-phase products are said to be more efficient at drawing large amounts of heat off equipment, making them more suitable for HPC and AI datacenter infrastructure.

A Market on the Move

The onslaught of AI and HPC has made liquid cooling more attractive than ever, and leading vendors such as Ciena are quickly moving to innovate, partner, and acquire key technologies.

In addition to Ciena's direct-to-plug approach, examples include power management vendor Eaton’s planned acquisition of Boyd Thermal for $9.5 billion and liquid cooling provider Vertiv’s purchase of PurgeRite for $1 billion. In both instances, acquired technologies will be incorporated in products.

Other vendors, including Green Revolution Cooling (GRC), Schneider Electric, CoolIT Systems, Submer, LiquidStack, and Iceotope, to name just a few, are profiting from the uptick in demand for liquid cooling.

For example, Vertiv, a market leader, recently posted third-quarter 2025 sales of $2,676 million, an increase of $602 million, or 29% year-over-year (y/y). Their press release stated:

“Orders accelerated, with third quarter 2025 organic orders increasing approximately 60% year-over-year and 20% sequentially from second quarter 2025. Vertiv’s TTM organic orders increased 21% compared to the prior year TTM period reflecting sustained market demand and increased market penetration, particularly in AI-driven infrastructure.”

Futuriom Take: Liquid cooling has become a major issue as datacenter chips and infrastructure get hotter and denser. Expect substantial growth and innovation in this market.