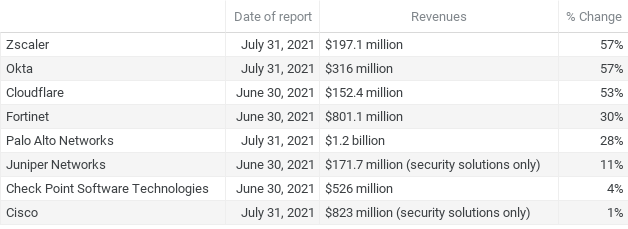

Security Upstarts Dominate Growth, While Cisco Trails

In cybersecurity, business is booming, especially for newer companies with cloud-native approaches and zero-trust network access (ZTNA) architectures. That’s the message of recent earnings reports from a sampling of market leaders.

A glance at the figures shows strong sales of cloud-native, zero-trust security solutions, as well as secure access service edge (SASE) wares from vendors like Cloudflare, Okta, and Zscaler. while longstanding incumbents that traditionally have sold firewall technology, including Cisco, haven’t fared as well. This seems true even though Cisco and other longtime players, such as Check Point, Juniper, and Palo Alto, have embraced the zero trust and SASE models.

Source: Company reports

Let’s take a closer look at the individual companies.

Winners

Cloudflare (NYSE: NET). While still relatively small compared to incumbent rivals, Cloudflare’s results showed impressive revenue growth of 53% in the vendor's latest quarterly report. Cloudflare, whose Magic WAN service conforms to zero-trust requirements, closed last quarter with 1,088 large customers, including the U.S. Department of Homeland Security. “We [signed] the equivalent of more than two six-figure customers every single business day in Q2,” said Matthew Prince, co-founder and CEO of Cloudflare, on the earnings call.

Fortinet (Nasdaq: FTNT). This vendor's overall revenues grew 30% in its latest quarter. Product revenue grew 41%. The company's popularity is owing to its focus on software-defined wide-area networking (SD-WAN) and ZTNA in consolidated solutions -- a SASE architecture. Recent talk of alleged exposure of 87,000 sets of credentials related to a vulnerability in FortiGate SSL VPNs hasn’t deterred Fortinet. The company says the hacks occurred on VPNs that had not been upgraded with a patch Fortinet provided a couple of years ago to cover a specific and well-documented vulnerability.

Okta (Nasdaq: OKTA). Like Cloudfare and Zscaler, Okta revenues grew over 50% last quarter. The vendor seems to be on a winning track, scoring 13,000 customers after acquiring Auth0 for $6.5 billion early in 2021. But Okta is losing a lot of money as well – GAAP net loss was $277 million for the quarter. Part of the issue is wrangling Auth0 into the product mix while focusing on further identity-based product development. Still, given the popularity of both Okta’s and Auth0’s products, revenue momentum should continue.

Zscaler (Nasdaq: ZS). By hitting the hot buttons of ZTNA and SASE, Zscaler’s cloud-native platform-as-a-service (PaaS) saw continued high revenue growth for the quarter ended July 31, 2021. Revenues for the full fiscal year ending on that date were $673 million, up 56% year-over-year. The vendor's Zscaler Private Access (ZPA) service did especially well, growing 166% to over $100 million for the fiscal year.

Laggards, for Now

Check Point Software Technologies (Nasdaq: CHKP). With 4% growth last quarter, Check Point isn’t in the same league with newer companies. Though it offers a full line of threat-protection products and services, including protection for mobile devices, Check Point seems to have been slower getting to a subscription model and positioning its products to best advantage in a rapidly shifting market. Still, the company is intent on improving its growth. It recently acquired Avanan, a prominent email security company, to add to its solution roster.

Cisco (Nasdaq: CSCO). Despite solid earnings, Cisco’s security revenues rose just 1% last quarter (compare that to 13% for its infrastructure products, including its switches). Despite having a range of products that cover cloud security and zero trust, the company appears to be perceived as a firewall supplier, aka a legacy security provider. Given time, this may change, particularly as Cisco is focused on a comprehensive approach integrated with its hardware.

Middlemen

Juniper (NYSE: JNPR). Juniper’s total security revenues grew 11%, but its security product sales grew 21% year-over-year. Juniper has strong technologies – it offers SASE capabilities along with containerized and virtual firewalling, as well as artificial intelligence-driven Mist AI technology and the session-aware solutions Juniper acquired with the purchase of 128 Technology in 2020. Getting it all together continues and should strengthen sales going forward.

Palo Alto Networks (NYSE: PANW). $1.2 billion in sales and growth of 28% show strength in this incumbents' prospects. "Something many cybersecurity companies have struggled to do is stay relevant," said CEO Nikesh Arora on the latest earnings call. To keep pace with current demands across a range of security functions, Palo Alto has over the last three years tripled the number of products it releases. While the vendor relied on its own development for over 80% of those new releases, it also has turned to acquisitions for the rest, resulting in a robust outlay over the last few months.

Watching the Trends

The latest financials appear to show enterprise customers favoring newer companies for ZTNA and SASE solutions. That said, it would be a mistake to discount more established firms whose product lines conform to those architectures, even though moving from legacy to leading-edge may be a struggle. Given the ongoing crisis in cybersecurity, solutions will only get stronger as vendors of all kinds move to offer solutions.