Cryptoskeptics Could Be Very Wrong

Curmudgeons aren't much fun. I know 'cause I used to be one. Then I discovered that cynicism is a barrier to opportunity -- quite possibly the largest opportunity in technology history in the blockchain and cryptocurrency markets.

It's easy to be a cryptocurrency troll these days -- whenever you are Jamie Dimon or Dennis Gartman, part of the financial establishment, they will roll you out on network TV to shout at the cryptoenthusiasts, calling them idiots. But some of this jaded commentary rings superficial and hollow as the boom in cryptocurrencies -- and anything blockchain -- continues unabated into the new year, with the institutional investors not even having dipped their toe in the water. What happens when Goldman Sachs gets involved and hedge funds start buying enthusiastically?

Calculating the Network Value

Cryptoskeptics are missing some key points. The main one is that cryptocurrencies are network assets, not standalone assets, and that value is created by the network effect as a specific blockchain network or cryptocurrency network is used.

One of the serial fears is regulation -- surely a reasonable concern -- though one could argue that attempts to regulate Bitcoin in China have been met with the distributed cryptocurrency finding new life elsewhere, scurrying around the blockchain like a financial cockroach. My argument would be that once enough money flows into the cryptocurrency system and institutional partners are part of the mix -- such as the CBOE -- enough political capital will be invested to let these assets live.

Can it be killed? Or maybe it is that the Matrix does not want it to be killed -- new distributed systems of exchange and more secure transactions will sprout up forever. They will grow or shrink in proportion to the value of the distributed networks to which they are tied. The power of blockchains, and by default some of the cryptocurrencies being attached to some of them, is their distributed, organic, and resilient nature.

Indeed, the financial establishment has a hard time valuing a cryptoasset because it has never seen anything like it before. Does this mean the value is more likely to decend to zero or rise exponentially, like a network effect?

Certainly, valuing an asset such as Bitcoin is not easy, but models are emerging to value it as a new asset class. Chris Burniske, a partner with Placeholder VC, has done some interesting work here, focused on the network value that is created. This includes some nifty formulas and spreadsheets that assign values to cryptoassets based on total addressable market (TAM), percent penetration of that market, velocity, and number of coins outstanding.

I think the basic debate on cryptocurrency comes down to whether you think the liquidity and facility of the successful cryptoasset exchange networks has value, as inputs in Burniske's formulas, or whether those values are worth little to nothing. I would bet on the former.

The Future Is Distributed

To me, the most exciting characteristic of blockchain networks is their distributed and collectively secure nature. They aren't owned by anyone. They don't belong to any one organization, corporation, person, or web address, which is the fundamental value of attraction. They are uniquely verifiable by the group. The distributed and collectively owned model makes the largest crypto networks an attractive alternative and threat to a centrally hosted systems.

This is a powerful trend, following up on the zeitgeist of the Internet. Can you really dismiss the entire thing as nonsense? Who likes centralized systems? Who likes human-driven bureaucracy? Who likes middlemen? Isn't freedom a greater alternative? Isn't this possibly one of the greatest trends of the 21st century -- much like Netflix's (NFLX) capability to liberate you from centrally controlled cable prison? I recall that the cable industry scoffed at Netflix in its early days, much as the banking system is scoffing at Bitcoin.

I have no idea what form the cryptocurrency networks and blockchain finally take, but I know that the movement is part of a larger political reaction to centrally controlled systems. Cryptocurrencies are a powerful political trend like gay marriage and legalized marijuana. If they gain enough momentum, can any of these things really be stopped by "the system"? The system did not work out well for people in 2008-2009, and I believe that the cryptocurrency market is a direct reflection of that.

Ethereum Proves Network = Value

As @TwoBitIdiot, aka Ryan Selkis, points out in what is already a classic post on the market, "95 Crypto Theses for 2018," the value of cryptocurrencies and the networks on which they reside is reflexive. The successful ones are self-fulfilling prophesies as traffic and transactions flow to them, to accrue value. This is how immensely popular networks such as email, the Internet, Google, and yes, even Facebook, were built.

The recent breakout in Ethereum -- both a cryptocurrency and a network for smart contracts -- demonstrates the reflexive value that can be quickly created by network effect. Ethereum is a blockchain-based network for smart contracts in addition to hosting its own cryptocurrency used on the network. A number of upgrades and continued innovation to upgrade the speed of transaction processing appear to have gotten notice, as Ethereum has been one of the stronger cryptocurrencies of late, passing $1,000 for the first time, establishing a new high just after the tulip cries of the cryptoskeptics.

The current crop of cryptocurrency skeptics being rolled out across TV, radio, and Internet media seem highly susceptible to embarrassment by the strength of their certitude. How can anybody possibly know what's going to happen? It's like attempting to predict the future of online shoe sales in 1999, before Zappos was even created.

If the value in the blockchain is recognized, we don't need to worry about monetization, as all great networks are created first and then monetized later. Just ask Google.

At the same time, the establishment appears weaker than ever. Equifax, the monopoly credit-rating system relied on by the bulk of North America's banks, has been breached. Fintech systems that use better data input and analytics seem smarter. The established "system" doesn't appear to be as robust as it once was. Transparency and distributed security could prove valuable in displacing more of the middleman brokers the desks of banks on Wall Street.

The Internet bubble comparison is apt. But it did not pay to be a skeptic on the Internet long term, even though it may have paid off in some of the shorter increments. The Internet bubble was effective in drawing huge amounts of capital into the space to create the largest economic boom in history -- and arguably a huge amount of value to the world, even though many companies did not, in fact, survive. This is normal. While it was a wild time of speculative excess, which resulted in many booms and crashes, nearly two decades later, the total value of the Internet has exceeded even the most wild optimistic expectations some people had in $1,000. In fact, on a macro scale, the optimists were right -- even though it was hard to pick winners on a micro scale.

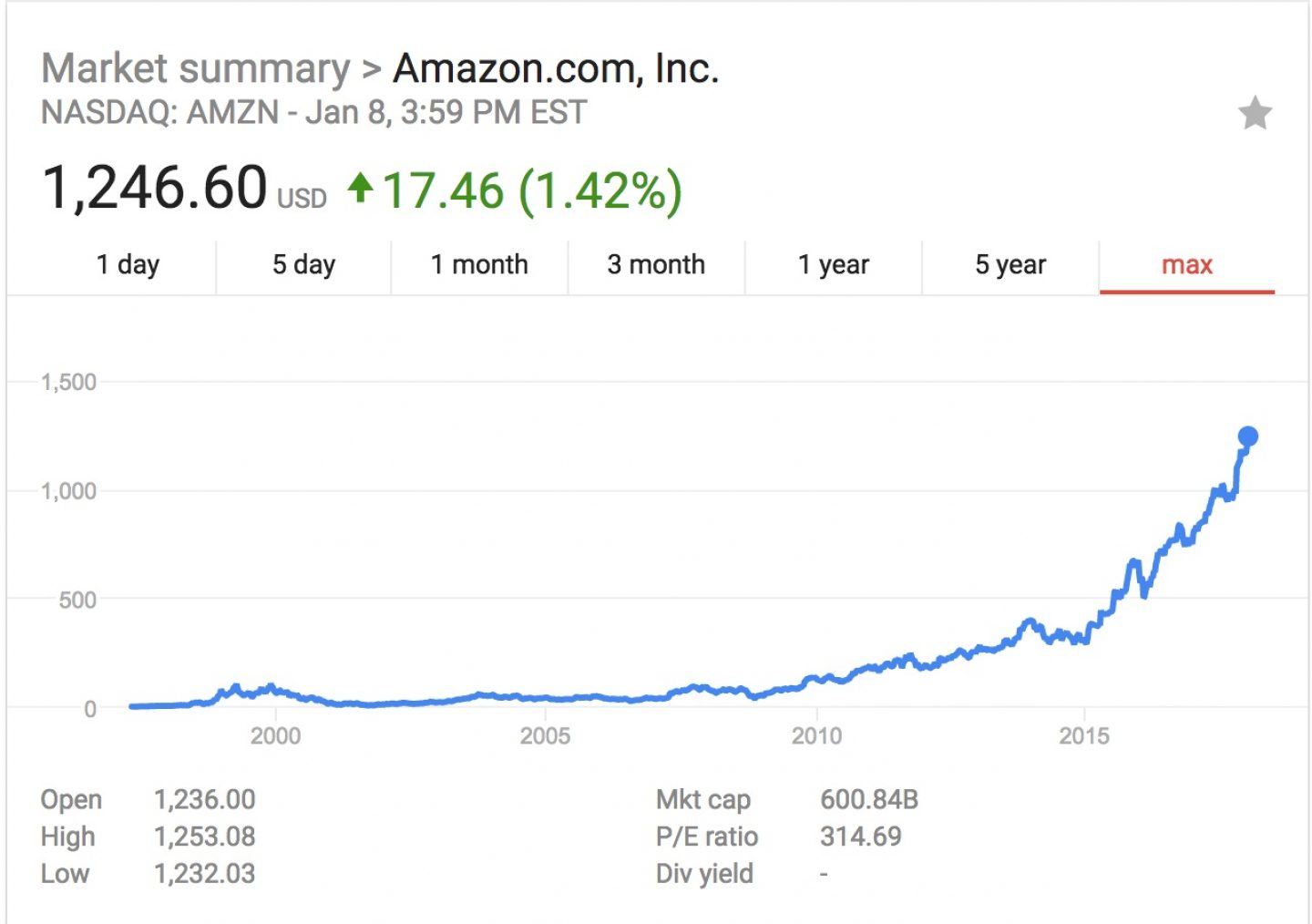

Let's just give two examples. Amazon and Priceline.

Or course, it's all in the timing. Buying Amazon at the IPO and sitting tight was a great move. Buying in January of 2000 and selling it in December of 2001 was not. Investing and speculation has two inputs, time and price, and without reference to both data points you can't prove a successful outcome. Many of the cryptoskeptics are already wrong with regard to time and price, having registered their down votes at a time when Bitcoin was $1,000 with prices now at $16,000.

In ten years' time, we will look back at this blockchain/cryptocurrency along the same lines. Some of the speculative excesses will seem fantastical and absurd, such as the 35,000% rise in Dogecoin. But at the same time there will be immensely valuable blockchain and financial transaction networks that will be among the most valuable resources in the world. My guess is that Ethereum is here to stay.

As reflexive assets, these networks gain value by attracting volume, trust, and velocity. The collective value of this model will prove worthy over time, though it's almost certain to go through a fascinating metamorphosis.

(Disclosure: The author holds a number of cryptocurrency assets, including Bitcoin and Ethereum. He also lives in Montana and is known to eat Elk Jerky and hoard survival food.)