Telcos Face More than the Lead Cable Issue

Have America’s telcos fallen on lean times? That seems to be the trend, given a spate of bad news for the communications service provider (CSP) industry.

The first recent blow hit U.S. carriers AT&T (NYSE: T), Verizon (NYSE: VZ), Frontier Communications (Nasdaq: FYBR), and Lumen (NYSE: LUMN) when a feature article in the Wall Street Journal revealed “America Is Wrapped in Miles of Toxic Lead Cables.”

All four companies saw their share prices drop after the initial July 9 article, which described how the carriers haven’t addressed the dangers of old-fashioned lead sheathing surrounding miles of U.S. legacy telecom cabling. The expose was followed by more bad news about the potential impact a cleanup and litigation could have on the bottom line.

More Bad News

The WSJ article was followed by a two-way punch from telco suppliers Ericsson (Nasdaq: ERIC) and Nokia (NYSE: NOK). On July 14, Ericsson reported sales down 9% for the second quarter and a stunning 42% drop in North American revenues.

“[W]e see the buildout pace being moderated, but we also see customer inventory levels being rebalanced,” said Ericsson CEO Borje Ekholm on the conference call. And Ericsson’s CFO Carl Mellander said: “[T]he decline there in North America was … due to lower capex spend as anticipated and also reductions of customer inventory following the very high investment levels in 2021 and 2022.”

The vendor’s assertions of rising 5G, cloud, and enterprise sales fell on deaf ears: Ericsson stock plunged nearly 12% over the past week.

The bad news just kept coming when Nokia on July 14 preannounced earnings results that were flat to down for its latest quarter, along with reduced annual expectations. The company, which relies predominantly on telco customers, described the downward shift as follows:

"The weaker demand outlook in the second half is due to both the macro-economic environment and customers’ inventory digestion. Customer spending plans are increasingly impacted by high inflation and rising interest rates along with some projects now slipping to 2024 – notably in North America. There is also inventory normalization happening at customers after the supply chain challenges of the past two years."

A Dreaded Distraction

Nokia's note that North American telco projects were slipping is significant. As shares tanked in the wake of the WSJ revelations, several analysts expressed fears that the impact of the poison cable issue could further drain already-diminished telco coffers and stall projects, particularly in the area of 5G, where telcos have disappointed their suppliers.

Still, as the days progressed, investor panic over the cabling problem subsided. As of this writing, all four of the carriers mentioned in the WSJ articles have seen their shares rebound: In early morning trading today (July 20), AT&T shares were up 8.48%; Verizon was up just over 5%; Lumen was trading up 16.67%; and Frontier Communications was up a whopping 26.28%.

“We do not deem the lead cable issue as a material threat to sales of telco gear,” wrote Raymond James analysts Simon Leopold and colleagues in a note yesterday. Indeed, litigation could draw the remediation out for years, making it less impactful on telco budgets.

A Deeper Problem

That doesn’t mean all is well on the telco front. The recent downturn in telco spending has, indeed, been anticipated. All three of the leading U.S. carriers have projected lower spending for the year, following a major outlay for 5G spectrum, fiber, and other gear over the preceding couple of years. AT&T, for example, has posted an outlook for capex to be flat with the $24 billion spent in 2022. And even if T-Mobile spends at the top of its proposed guidance range in 2023, that would be about 30% less than it did in 2022. Verizon too would spend over 16% less if it tops the range of its current guidance.

There is, too, a sense that telcos have yet to mine the potential for 5G in the enterprise space. The 5G standalone networks required to offer robust private 5G services are rolling out slowly. And there is evidence that telcos aren't buying into 5G as their suppliers had hoped. Nokia CEO Pekka Lundmark stated in Nokia's second-quarter earnings release this week:

"In Mobile Networks there is still substantial need for operators to invest in 5G globally with only approximately 25% of the potential mid-band 5G base stations so far deployed outside China.”

Hyperscaler, Enterprise Spending Up

While the telcos scale back, the same suppliers that rely heavily on the telco market are seeing an uptick in spending by large enterprise customers and, even more importantly, public cloud service providers or hyperscalers such as AWS, Microsoft, and Google Cloud.

This trend is causing a shift in strategy."[M]oving forward we see growth opportunities supported by the work we have been doing to diversify our customer base by growing in enterprise and webscale," stated CEO Lundmark in today's earnings release. Enterprise sales grew 27% in constant currency for the quarter, Nokia reported.

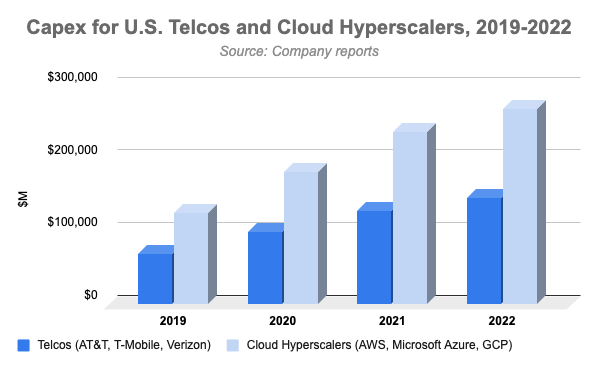

Significantly, hyperscaler spending has nearly doubled that of the telcos in recent years, according to Futuriom research. Further, the cloud titans are taking the lead in shaping technology trends such as AI, hybrid cloud, and edge computing. And it's been established that the hyperscalers have not just been helping to create 5G functionality in telco networks but have also branched out on their own in offering private 5G services to enterprise customers.

Ultimately, signs are that telco spending is scaled back significantly and probably won't pick up over the next year. Meanwhile, it seems the lead cable issue will persist until it is resolved by legislation that forces the telcos to act. That could buy time for the carriers, perhaps allowing them to catch up to the hyperscalers in a number of emerging areas.

Futuriom Take: The lead cable issue is significant for the companies responsible, but judging by past environmental impact cases involving industries, its financial impact will probably play out over many years. Meanwhile, telcos face another issue, namely, that hyperscalers are taking the lead in shaping technology trends, particularly for enterprise customers. Unless they can seize the opportunities presented by AI, 5G, and edge compute, the CSPs again face becoming “dumb pipe suppliers.”