Cloud Firms Are Upping Capex, Citing Demand

The top three public cloud service providers say they are seeing so much growth in AI and cloud services that they’re making substantial increases in capital spending (capex). And that has investors asking questions.

To start from the top: Amazon posted first-quarter net sales of $143.3 billion, up 13% year-over-year (y/y) and topping Wall Street’s expectations of $142.5 billion. AWS specifically grew 17% y/y to $25 billion, above the Street’s $24.5 billion average. AWS now accounts for 15% of Amazon’s total sales. And that portion should grow with substantial investment in infrastructure. Amazon says the $14 billion spent on capex last quarter is just the start.

“We expect the combination of AWS's reaccelerating growth and high demand for gen AI to meaningfully increase year-over-year capital expenditures in 2024,” said Amazon CEO Andy Jassy on the earnings call April 30. “The more demand AWS has, the more we have to procure new data centers, power and hardware.”

Microsoft reported net sales of $61.9 billion, up 17%. Of that, the company’s Intelligent Cloud segment, which is a kitchen sink of multiple software and services revenue that includes Azure, rose 21% to $26.7 billion, above the Street consensus of about $26.24 billion. A revenue slice comprising Azure and “other cloud” services, which was up 31% this quarter, is expected to do just as well next quarter—between 30% and 31%, specifically.

Azure—and the rest of Intelligent Cloud—now accounts for about 43% of Microsoft sales. And that justifies more capex than the $14 billion Microsoft spent this past quarter, execs said. “We expect capital expenditures to increase materially on a sequential basis driven by cloud and AI infrastructure investments,” said Amy Hood, CFO, on the company earnings call April 25.

Google Cloud revenue was $9.6 billion, up 28% y/y. Google Cloud accounted for about 12% of parent Alphabet’s $80.5 billion this quarter (which in turn represented growth of 15% y/y). Notably, Google Cloud’s operating income, which showed a loss for years, was $900 million this quarter, up 371% y/y.

So Google Cloud is also moving the capex needle. “We are committed to making the investments required to keep us at the leading edge in technical infrastructure. You can see that from the increases in our capital expenditures. This will fuel growth in Cloud, help us push the frontiers of AI models, and enable innovation across our services, especially in Search,” said Alphabet CEO Sundar Pichai on the earnings call April 25.

Questions About Growth

Investors are concerned about the amounts cloud hyperscalers are willing to spend on generative AI and cloud services—and the combination of both. Layoffs, for instance, were significant for all three in the not-so-distant past. Over the past year and half, Amazon has trimmed over 27,000 employees from its roster. Last summer, Microsoft was adding to a massive round of 10,000 layoffs. And Google Cloud reportedly laid off at least 1,000 workers early this year.

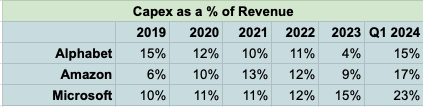

In contrast, the hyperscalers are increasing their amount of capex as a percentage of revenue significantly, as shown in the following chart:

Source: Company reports

At least one analyst questioned this trend on Microsoft’s earnings call: “So, obviously, investments are coming well ahead of the revenue contribution…. [Could you] quantify the potential opportunities that underlie these investments because they are getting very big.” To which CEO Satya Nadella answered, “[I]t’s all going to be demand driven.”

Demand was cited by all three as a reason for capex growth.

“[W]e are seeing strong demand signals from our customers and longer deals and larger commitments, many with generative AI components. So those signals are giving us confidence in our expansion of capital in this area,” said Amazon CFO Brian Olsavsky on the earnings call.

“With respect to Google Cloud, performance in Q1 reflects strong demand for our GCP infrastructure and solutions as well as the contribution from our Workspace productivity tools,” said Ruth Porat, Alphabet CFO, on the earnings call. “The growth we are seeing across Cloud is underpinned by the benefit AI provides for our customers. We continue to invest aggressively while remaining focused on profitable growth.”

Big Spending for Big Customers

All three hyperscalers said demand for AI and cloud is coming from large enterprise customers. “At Google Cloud Next, more than 300 customers and partners spoke about their generative AI successes with Google Cloud, including global brands like Bayer, Cintas, Mercedes Benz, Walmart, and many more,” said Alphabet CEO Pichai on the earnings call.

Amazon CEO Andy Jassy said: “Customers are gravitating to Q [Amazon’s Gen AI assistant], and we already see companies like Brightcove, Bridge Telecom, Datadog, GitLab, GoDaddy, National Australia Bank, NCS, Netsmart, Slalom, Smartsheet, Sun Life, Tata Consultancy Services, Toyota, and Wiz using Q, and we've only been in beta until today.”

Futuriom Take: The cloud titans see sufficient demand for AI and cloud services to justify substantially increased capital spending for the foreseeable future. If demand is as high as they claim, perhaps AI will save everyone’s bacon.