Telco and Cloud Finances in 2024: What to Expect

Will 2024 be a down year for telcos and cloud hyperscalers? That’s the question that haunted recent earnings calls from both camps. And the answer seems to be: It depends.

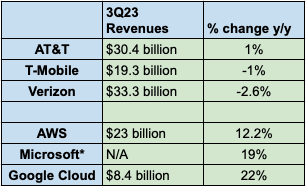

To review: The leading U.S. telcos, including AT&T, T-Mobile, and Verizon, posted lukewarm third-quarter earnings results. And the cloud hyperscalers delivered a mixed message, with Microsoft pulling ahead of Google Cloud and AWS posting solid growth. All three, however, continued to see double-digit revenue growth, albeit less than they’ve enjoyed in past quarters, as shown in the table below:

*Microsoft's calendar Q3 2023 is its fiscal Q1 2024. Source: Also, Microsoft does not break out Azure revenues, so sales shown are for Intelligent Cloud. Source: Company reports

What does this say about the specific customer markets for both hyperscalers and telcos? Are quarterly reductions in revenue reflective of an overall "optimization" slowdown in spending by enterprise IT? Let’s ask the leading players:

To access the rest of this article, you need a Futuriom CLOUD TRACKER PRO subscription — see below.

Access CLOUD TRACKER PRO

|

CLOUD TRACKER PRO Subscribers — Sign In |