What’s Going on in Satellite SD-WAN?

For decades, satellite networks have linked many offshore or offline locations to the enterprise WAN — from oil rigs in the North Sea to mining locations in Africa to shipping lanes through the Persian Gulf.

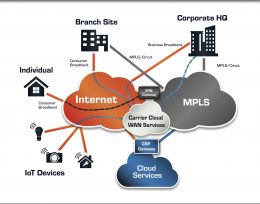

Now that software-defined networking (SD-WAN) heralds the transformation of enterprise and government networks, satellite connections are experiencing a makeover as well. Many SD-WAN providers see satellite links as key to edge compute setups, along with 5G and other access technologies. Likewise, satellite makers and service providers are working to improve the traditional issues of satellite networking, like cost and network performance. And everyone hopes the resulting high tide of demand for high-bandwidth applications like IoT analytics, machine learning, virtual reality, and autonomous vehicles will float all boats.

None of this will happen quickly. SD-WAN spending has slowed up for the moment, and markets associated with cloud computing will likely move in fits and starts. Still, plans to bring satellite connections into managed cloud services is forcing innovation. Smaller satellites, optical ground stations, cheaper launch mechanisms, and streamlined antenna setups not only will improve satellite connections to SD-WAN but will open new markets for equipment and services.

SD-WANs Add Satellite Support

To scan the state of the SD-WAN/satellite access market, let’s take a look at how some leading cloud providers are extending their services to draw satellite connections into their clouds:

- Amazon announced in July that its AWS Ground Station program, unveiled in November 2018 in a partnership with Lockheed Martin, is now integrated with ground stations from Atlas Space Operations, a company that offers “satellite communications as a service.” The deal is a huge efficiency for Amazon, since Atlas has already simplified some of the complicated regulatory and management requirements of working with LEO satellites. Amazon also plans to boost its SD-WAN-enabled network of ground stations through partnerships with a raft of satellite firms, including Capella Space, D-Orbit, Maxar Technologies, Myriota, NSLComm, and Thales Alenia Space, among others.

- Microsoft announced a partnership with Ball Aerospace in September. In a demonstration for the U.S. Air Force, Microsoft showed how Azure ExpressRoute, which brings private broadband satellite connections into Microsoft’s Azure SD-WAN cloud, might connect to a planned constellation of small satellites for military use. This could become a big deal if the U.S. defense project is approved. Meanwhile, Microsoft also announced that Azure ExpressRoute now supports satellite networks from SES, Intelsat, and Viasat. Those satellite vendors deal in Geostationary (GEO) and Medium Earth Orbit (MEO) satellites, which represent the majority of satellites in use today.

- VMware was cited in June by Mexican cloud service provider Elara Comunicaciones, which announced an alliance with VMware resulting in a new SD-WAN cloud for Elara enterprise customers. One of these customers is PEMSA, a Mexican oil and gas subsidiary of Grupo Mexico, which adopted the new cloud service to gain network visibility, security management, analytics, and other services for its remote drilling platforms and camps. The sheer size of PEMSA and its parent is a good endorsement of VMware in a market where remote access is important to many companies and government entities.

MEO and LEO Efforts Unleashed

Providers of satellite gear and services also are reaching out to SD-WAN from their vantage points. By improving their equipment and software, sometimes dramatically, the industries that make satellite infrastructure are actually creating new kinds of networks. And they’re doing so with a keen eye to hooking into SD-WAN clouds.

SES Networks has been especially vocal about adapting its large MEO and GEO gear to SD-WAN. It recently unveiled its SD-WAN managed service strategy. SES is pitching tight integration between satellite networks and SD-WAN so that enterprise and government customers can buy an “as a service” packages. In August, SES unveiled an implementation of the Linux-specified Open Network Automation Platform, along with Microsoft Azure and Amdocs. In September, the satellite conglomerate announced that Microsoft has adapted its Azure ExpressRoute software to work on private SES networks. Also in September, the company announced a scheduled 2021 launch of seven MEO satellites aboard a SpaceX Falcon 9 rocket out of Cape Canaveral. SES says its O3b mPOWER MEO system will be “capable of generating thousands of electronically-steered beams that can be dynamically adjusted to serve customers in various markets including telecom and cloud, communications-on-the-move and government."

Notably, the European Space Agency claims that MEO satellites are likely to gain popularity as 5G transmission points, thanks to their low latency compared to GEO gear and their wide geographical reach. So the SES focus on SD-WAN could also help it stay current if and when applications dependent on 5G proliferate in the future.

SES has worked to add SD-WAN links not only to its improved MEO satellite gear, but also to its GEO satellites, thereby offering unified access to both types of satellite connections, which effectively cover nearly all commercial and government applications today. Use cases include broadband failover for terrestrial fiber, 4G/LTE, WiFi, and other access technologies. The company’s SD-WAN support could give it significant advantage as it courts large enterprises.

NSLComm, in contrast, represents a growing technology focus on small, fast satellites aimed at IoT applications. NSLComm recently announced plans to launch a nanosatellite named NSLSat-2. The small satellite is slated for launch within six months, joining an earlier satellite called NSLSat-1 that the company hoisted into space via the Russian Soyuz rocket in July of this year. Both satellites feature a flexible antenna that NSLComm says dramatically reduces the costs of launching and maintaining the Low Earth Orbit (LEO) Ka-band gear, while also increasing the throughput rate once in orbit by nearly 100 times that of other nanosatellites made by the likes of GomSpace, Astrocast, Blue Canyon Technologies, and others.

As a result of improved speed, NSLComm claims to offer companies in oil, shipping, agriculture, and other fields a cheaper and faster way into IoT. The startup plans to launch 30 more satellites by 2021, with help from its impressive list of partners and funders, including Jerusalem Venture Partners, OurCrowd, Cockpit Innovation, and Liberty Technology Venture Capital. Recall that the Israeli company, which reportedly has garnered $16 million in funding since 2015 and is endorsed by the Israeli Space Agency, has signed on as an Amazon AWS Ground Station partner for future projects.

Alphabet, the Google parent, is also focused on small satellites. Last year, the company invested in SpinLaunch, a catapult-like technology for hoisting small satellites into LEO. Now there may be a contract from the U.S. Department of Defense. If Alphabet aims to play in the small satellite space, this could supply the leverage (pun intended) needed to give it a massive head start on entering that market. But again, this could take at least two years to pan out.

Still, given Google’s efforts to enhance Google Cloud’s artificial intelligence, analytics, and IoT capabilities by incorporating satellite data along with all kinds of other information, it’s reasonable to assume Google will focus over time on putting together small satellites, analytics, and SD-WAN for IoT and other applications.

Key to the Edge?

Satellite technology and SD-WAN are an important pairing to watch, as enterprises look to bring a range of satellite data down from orbit into the cloud edge. Still, while there will be some breakthroughs and successes near term, it’s probable that the complex web of partnerships required to really get this trend going will take a long time.

Growth in other access markets, such as 5G, should boost interest in IoT, and with that, satellite data, which will play a sizable role in tracking industrial systems, boats, offshore drilling platforms, agricultural facilities, remote broadband-based field offices, and more. Further, advances in broadcasting, GPS, and mapping analytics could add to the buildup of demand for satellite connections.

Many players, many moving parts, many hopes and ideas. Watch this (outer) space.