Rubrik IPO Represents Larger Trend

Rubrik, the 11-year-old secondary storage and security cloud provider, is going public in a move that reflects an influx of new blood in the public tech markets.

According to its SEC S1/A and prospectus filed yesterday, the company intends to sell 23 million shares at $28 to $31 per share, raising up to $713 million. Sources put the current valuation of the company at $5.4 billion. As of January this year, the company had raised over $553 million, plus “tens of millions” from a stake by Microsoft.

Rubrik’s prospectus depicts robust financials and a solid market opportunity. From January 31, 2023, to January 31, 2024, subscription annual recurring revenue (ARR) rose 47% to $784 million, $525 million of which came from cloud services. The company claims over 6,100 customers, 1,742 of which represent orders at or over $100,000 annually.

All of this reflects a rapidly growing market for cybersecurity and cloud protection. According to the prospectus, Gartner estimates put the total addressable market for Rubrik’s platform at $36.3 billion through the end of 2024, growing to $52.9 billion by the end of 2027 – a compound annual growth rate (CAGR) of $13%. Those figures encompass growth in the particular segments Rubrik’s targeted: data management, backup and recovery software, application security, cloud security, cloud security posture management, data security, and privileged access management software.

Rubrik Anticipated Market Demand

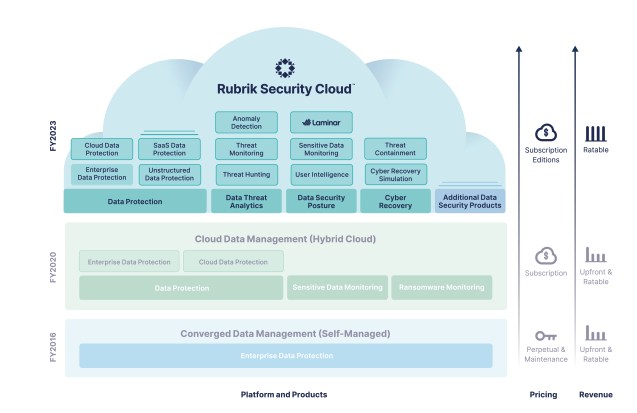

Rubrik’s journey to IPO has been marked by anticipation of and response to market demand. Over time, it’s migrated its strategy from cloud and on-prem products to offer a single software-as-a-service (SaaS) called Rubrik Security Cloud (RSC) that encompasses zero-trust security for enterprise, cloud, and SaaS applications. The service offers data monitoring and management, threat hunting and containment, and cyber recovery from ransomware threats.

Rubrik Security Cloud (RSC). Source: Rubrik

Rubrik’s also hopped on the generative AI train with the release of an AI backup expert named Ruby, which it calls a "generative AI companion" within RSC that identifies threats to stored data and assists with remediation and recovery.

Rubrik’s IPO Part of a Broader Trend

The success of Rubrik, a Futuriom 50 company, is also part of a broader industry trend among high-growth startups, namely the move to IPO following a couple of years of market avoidance. Astera Labs (Nasdaq: ALAB) just raised $713 million (a magic number? See above), more than it anticipated. Reddit (NYSE: RDDT) launched a successful IPO in March. Ibotta, an e-commerce software provider backed by Walmart, is expected to launch its IPO shortly.

On top of all this, data management and AI provider Databricks is rumored to be considering its own IPO, though the date's uncertain.

All of this is good news, but with accompanying cautionary guardrails. The public markets remain volatile amid geopolitical upheaval and uncertainties. Astera and Reddit are showing steady losses over the past few days, pointing to the need for ongoing growth to bolster the stock. Certainly Rubrik won’t be immune to that pressure.

Rubrik is expected to trade on the NYSE under the ticker symbol RBRK.