The 2024 Futuriom 50 Is Here!

Every year, Futuriom kicks off the year with a review of the top trends in cloud and communications infrastructure for 2024. We also identify the top 50 companies we think are riding these trends toward acquisition or Initial Public Offering (IPO).

The top theme right now is, of course, AI. The massive amount of money that has flowed into the AI market is having a disproportionate effect on infrastructure, as organizations worldwide prepare for a long cycle of upgrading compute, networking, and storage infrastructure to handle the extreme demands of AI (more data and processing).

But there's way more than AI going on. IT organizations are dealing with the constant evolving challenges of managing infrastructure, including increased complexity, ever-present security risks, and managing data. Here are the top trends we see for 2024:

- Trend #1: Hybrid and Multicloud Infrastructure

- Trend #2: AI Infrastructure

- Trend #3: Edge Cloud and Data Management Convergence

- Trend #4: Cloud-Cost Management and FinOps

- Trend #5: Cloud Visibility and Automation

- Trend #6: Cloud Security Convergence

Top IPO Candidates

One of the goals of the F50 is to identify IPO or acquisition prospects. With the market volatility in the past two years, the IPO market for technology companies has been subdued. 2023 was a bit of a roller-coaster year in the financial markets, and the IPO window is still shut -- though not quite as tightly with the prospect of the Federal Reserve lowering interest rates.

Despite this, there are still many candidates lined up on the runway, ready to hear from the investment banker control tower in New York. Among our Futuriom 50 companies, those with the most potential for IPO include: Databricks (three years on the list), which might be the most closely watched pre-IPO company; and Cohesity (which was taken off because it had already filed for IPO, which it later withdrew). Databricks sits squarely in the red-hot data management and data lake space, and the IPO is likely to be a hot offering, with the company last valued at around $45 billion. Additional maturing companies to watch for potential IPO include Aryaka Networks, Cato Networks, Cockroach Labs, Fivetran, Netskope, Rubrik, and Versa Networks.

The total amount of money raised by the companies on the 2024 Futuriom 50 is now $14 billion. Databricks still holds the top honors, having raised $4.1 billion.

The full list of Futuriom 50 companies: Arrcus, Aryaka Networks, Aviatrix, Aviz Networks, CAST AI, Cato Networks, Chronosphere, ClearBlade, Cockroach Labs, Databricks, Dragos, DriveNets, Enfabrica, Engflow, Exabeam, Fermyon, Fivetran, Fortanix, Graphiant, Hazelcast, Hedgehog, IP Fabric, Itential, Kentik, Kong, Kubecost, Lacework, Netris, Netskope, Orca Security, Prosimo, ProsperOps, Pulumi, Qumulo, Rubrik, Selector, Sonar, Stellar Cyber, Striim, Tecton, Teleport, Tetrate, Tigera, TrueFort, Vantage, Versa Networks, Virtana, Wib, Yugabyte, Zesty.

The details of all the trends can be found in the report, which is free to registered users of Futuriom.com.

Total length: 63 pages

Cost: Free to registered Futuriom.com users.

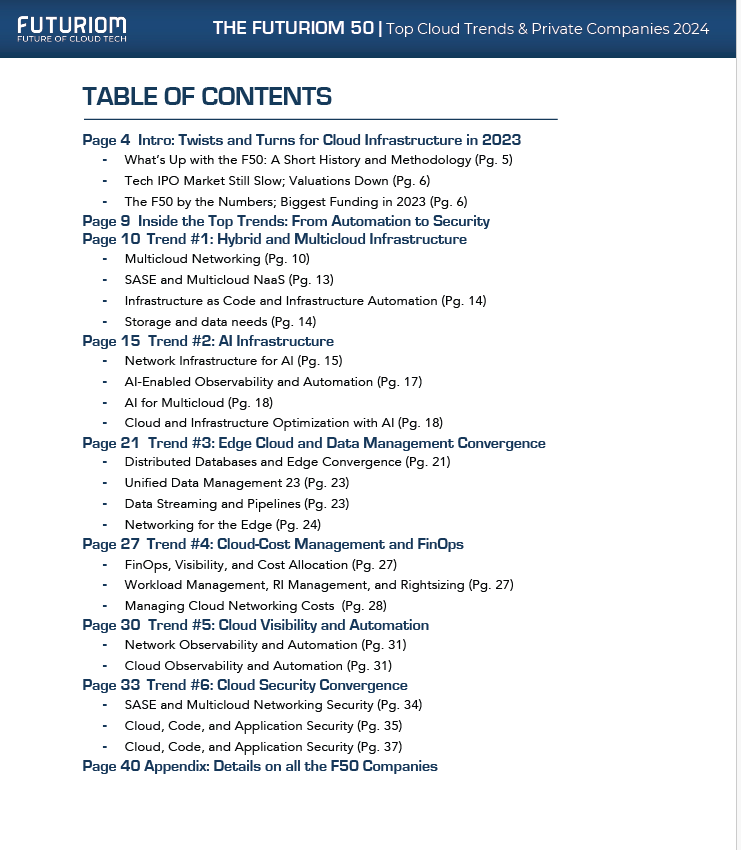

Table of Contents: See below.

You can download the report here!

Futuriom 50 Methodology

Futuriom analysts stay on top of the F40 throughout the year, tracking news, partnerships, funding, and technology implementations. A significant source of our intelligence comes from our work on Futuriom Cloud Market Trend Reports (CMTRs), which we publish monthly. In additional, we gather information on cloud technology trends from the 4-5 end-user surveys we collect throughout the year.

After combing through our CMTRs and having our analyst team build a database of companies, we arrive at a short list of about 70 companies. We further vet these companies on a weekly basis for two months. Each week, we eliminate some companies until we come up with our final list at the beginning of January.

If a company is removed, that doesn't mean those companies can’t succeed – it just means they are no longer on our list of the most promising companies that we track. It’s possible we missed something, or that they are being revitalized with new technology and deals, and they can return to the list. For now, however, it’s our subjective opinion that they’re not currently members of our elite class.

This has been an exciting project that helps guide our research and cloud technology teams for the rest of the year. And of course, we will start right now tracking these companies and starting to compile potential new companies for the 2023 list! We expect many more successful exits.