Interest in Remote Tech, Security Gains in COVID Crisis

While the humanitarian toll of the COVID-19 pandemic is obvious, the economic effects remain unclear. Many analysts predict a global recession for 2020, and ongoing market volatility seems guaranteed. But there are signs that some sectors, including remote access, cybersecurity, and cloud services, could actually gain.

What's more, the current reliance on remote and virtual networking could signal the start of a faster move toward software-defined wide-area networking (SD-WAN), edge computing, 5G mobility, and other elements of emerging cloud-based enterprise infrastructure.

Remote Tech on the Rise

The close of workplaces due to COVID-19 and the resulting pivot to telecommuting has forced companies to reconsider their workplace IT strategies. For example, in a note published this week, analysts from financial advisory firm Raymond James & Associates (RJ) acknowledged that their own company has moved aggressively to accommodate remote work. Their IT department has reportedly ordered thousands of new laptops and doubled its order for virtual workspace solutions from Citrix Systems Inc. (Nasdaq: CTXS), whose stock is among those firms that have drawn attention due to perceived demand. Raymond James also has increased bandwidth from public network suppliers such as Verizon (NYSE: VZ) by 40%.

The Raymond James analysts see their experience as typical of a potential surge in digital transformation. Their note states: "[T]he IT team sees this as part of longer term shift to a more mobile/work-from-home workforce as both RJ (and other firms) get more comfortable that they can operate this way."

The RJ analysts predict positive demand across a range of market slices, including remote desktop software and services; authentication and endpoint technologies that support remote access, particularly zero trust access; virtual private network services (VPNs); and next-generation laptops, firewalls, and routing equipment.

Teamwork Tools on Track

As enterprise IT struggles to adjust to the challenges of a reconfigured workforce, small workgroups also are flocking to online Web conferencing, collaboration, and messaging platforms, including Teams from Microsoft (Nasdaq: MSFT), Webex from Cisco (Nasdaq: CSCO), and products from Zoom (Nasdaq: ZM) and Slack (NYSE: WORK). Other companies see an opportunity to help out and gain visibility: Intermedia, for instance, is offering its cloud collaboration service AnyMeeting Pro free to new users through the end of 2020.

Enterprises are examining their security practices as they expand workers' remote access. As Alex Willis, BlackBerry VP of sales engineering and ISV partners, recently told Forbes, the risks of endpoint devices such as remote home laptops include data leakage, whether intentional or not.

Also, as ever in a crisis, malevolent forces are unleashed: Ransomware attacks are increasing despite claims that cybergangs will spare hospitals and medical facilities. And malware sales are brisk on dark web sites.

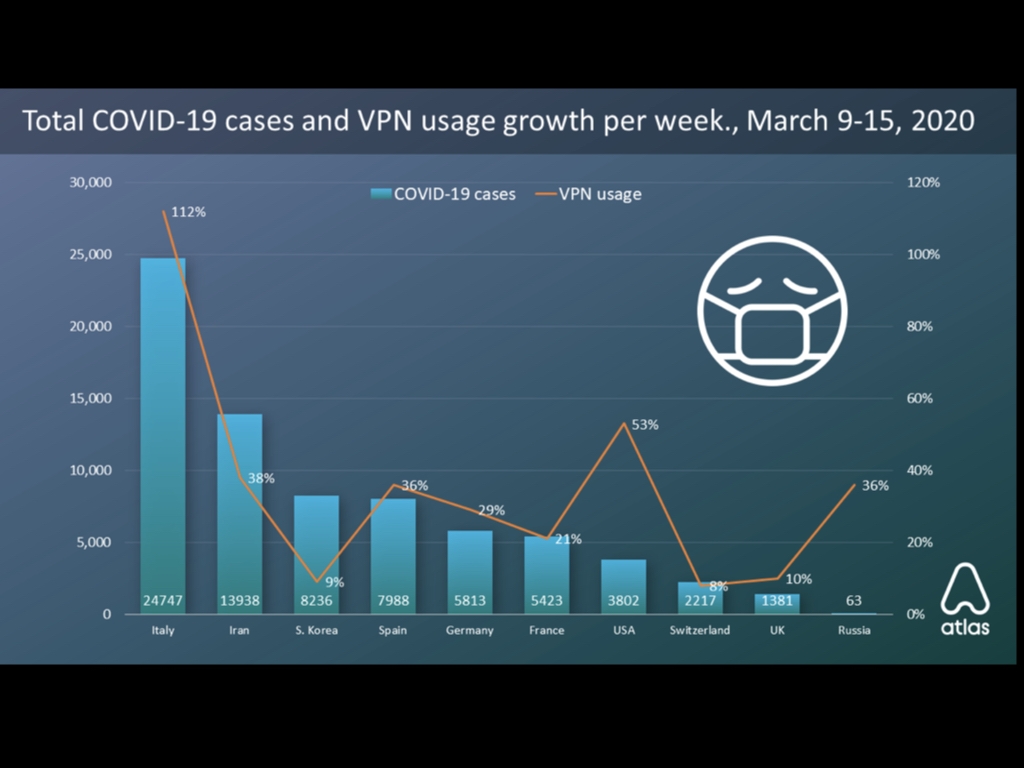

Many enterprises are seeking protection via virtual private network (VPN) services from commercial suppliers such as Atlas VPN, ExpressVPN, and NordVPN, which combine global reach with reputability (not always a feature of VPNs). These companies are reporting double- and triple-digit growth as the virus slams businesses worldwide. Atlas VPN, for instance, recently released the following chart in a blog:

Suppliers of software-defined wide-area networking (SD-WAN) also see opportunity in the rush to secure remote work. Aryaka and Extreme Networks (Nasdaq: EXTR) have moved to address demand for secure remote access — Aryaka through promoting its Secure Remote Access (SRA) service, which concentrates VPN links and improves cloud application performance; and Extreme Networks by promoting its Portable Branch Kits along with a service it’s calling “a quick-response, cloud-managed Wi-Fi 6 mesh network solution” that acts as a “secure, encrypted extension to the existing hospital infrastructure that maintains HIPAA compliance” for “pop-up clinics, testing facilities or quarantine sites.

Where It’s Headed

In current uncertain circumstances, it’s tough to make any predictions. But the crisis unfolding worldwide is highlighting the need for cybersecurity and cloud services as never before. And the move to remote work could hasten demand for better, faster networks via 5G. That in turn could spur activity across all markets serving digital transformation.

All of this gives a slightly hopeful aspect to the currently bleak market environment. In some ways, the COVID-19 challenge could benefit enteprise computing. Whether it could lift markets is another matter. Certainly, nothing will happen until the crisis takes its own turn for the better. We all hope that happens soon.