China Finally Approves Nvidia-Mellanox Deal

Nvidia (Nasdaq: NVDA) may finally be able to pay $6.9 billion to acquire Mellanox Technologies Ltd. (Nasdaq: MLNX). The deal has been conditionally approved by China’s regulatory agency, the PRC’s State Administration for Market Regulation (SAMR), paving the way for the emergence of a powerful contender in high performance computing (HPC) and cloud environments.

According to Seeking Alpha, SAMR has given its approval but stipulates that the merged companies must not create any “unreasonable” marketing strategies when selling in China, such as requiring products to be sold as bundles.

An HPC Power Trio on Deck

As Futuriom reported last month, Nvidia’s Mellanox acquisition had stalled for more than a year thanks to SAMR waffling, which probably wasn’t helped by trade wrangling. But during the wait, Mellanox moved to buy privately held Titan IC for an undisclosed sum. Titan’s RXP processors offload network, security, and storage tasks from CPUs via artificial intelligence (AI). The RXP was already licensed for use in Mellanox BlueField IPUs prior to the Mellanox takeover.

As Futuriom speculated in March, Titan IC’s base in Belfast, U.K., may have encouraged China’s SAMR in its decision. Not only was Titan IC based in Europe, not the contentious U.S., but its proximity to Arm, the U.K.-based provider of processor, software, and development tools that is partly owned by a consortium of Chinese investors, bode well for future commercial relations. Also, both Titan IC and Nvidia had existing relationships with Arm.

Bright Future for HPC, Cloud, Edge

With the Great Wall of SAMR breached at last, Nvidia, Mellanox, and Titan IC stand ready to provide the kind of offloaded processing required in today’s high-performance cloud networks — including that portion at the network edge.

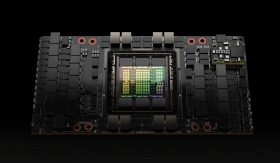

Mellanox makes high-performance, 200-Gbit/s smart network interface cards (SmartNICs). With Nvidia processors and Titan chips, these SmartNICs could enable hybrid clouds to support ever-growing traffic volumes and to meet demand for enormous processing power required by functions such as artificial intelligence (AI) and cybersecurity.

Challenges to Deal

Still, though Mellanox and Titan IC have already blended their wares, the merger with Nvidia, like all major deals, presents challenges. Management policies, strategic planning, and just getting it all together will take time.

Meanwhile, competitors aren’t standing still. Intel (Nasdaq: INTC), for instance, which made its own acquisition of the Smart Edge software division of Canada’s Pivot Technology last fall, has been quietly building an arsenal of edge compute power products, including ones geared to 5G mobile.

The Nvidia/Mellanox/Titan IC power trio isn’t guaranteed success, no matter how rosy its future looks now. Expect more market activity in this space, as edge cloud architecture becomes a major market battleground.