At MWC, Telecoms Look for the Answer in AIOps

The telecommunications industry is in a rough spot. Revenue growth and profitability is declining. Operations costs are high. With the first wave of major 5G adoption already fulfilled, the question is now about how to operate more efficiently to drive down costs.

The industry is increasingly looking at AI Operations (AIOps) and other automation technologies to cut costs and boost productivity. Expect this to be a big topic of discussion at this year’s Mobile World Congress in Barcelona, which takes place next week.

(Editor's note: Since this story was published, there has been more activity around the AIOps in telecom space with the announcement of the AI-RAN Alliance."

Inside the Telecom Slump

First, let’s look at industry dynamics. Then let’s look at what’s going to have to be done.

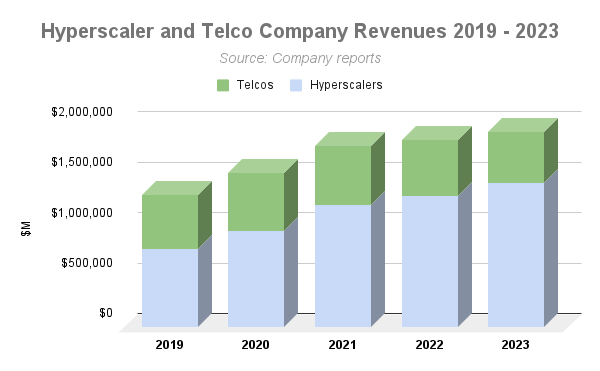

As Mary Jander has presented in our Cloud Tracker Pro analysis service, the telecoms companies continue to be outgunned by the hyperscaler cloud providers, which are more profitable and have considerable firepower to build new infrastructure. As you can see in the revenue chart below, the hyperscalers are growing faster than the telecom industry and have become a bigger force overall.

This is a big problem in the long run, because the simplest way to think about this is that the hyperscalers have more infrastructure and services for business customers and consumers alike.

The AI boom will no doubt drive more demand for data and connectivity services, but it’s looking like the hyperscalers are benefitting more than telecom, as the center of connectivity gravity shifts to the cloud. Recently, this may have contributed to an erosion of business services in telecom. One particular area of pain is the lack of uptick in business services such as private 5G or broadband, which has failed to compensate for the loss of business wireline access and wholesale business connections.

AT&T saw its Business Wireline revenues fall -7.3% for 2023 compared to the prior year, and the long-ailing segment’s operating income fell -43.7%.

“We expect legacy Business Wireline declines to be partially offset by incremental cost savings and increased fiber and fixed wireless revenues [in 2024],” said Pascal Desroches, AT&T EVP and CFO, on the company’s year-end earnings call January 24, 2024.

Verizon Business too saw revenues reduced -3.6% year-over-year at the end of 2023. The division contains Verizon’s IoT, edge solutions, private 5G, and managed network services (including SD-WAN and a recently introduced multicloud and hybrid cloud management offering). The group was devalued in Verizon’s accounting by $5.8 billion last year. It has also had a leadership change, with Kyle Malady replacing Sowmayanarayan Sampath in March 2023 as EVP and CEO of Verizon Business Group. (Sampath moved on to become EVP and CEO of Verizon’s Consumer Group.)

Interest in AIOps Grows

So what’s next? The industry needs a new competitive edge, and they see AI as part of that story. In the near term, it’s not likely that the telecoms are positioned to benefit from AI on the services growth side. But they can use AI in operations – AIOps – to increase automation and reduce costs.

Some of the potential for AI was reflected recently in a survey of the industry presented by NVIDIA. Data from the State of AI in Telecommunications Survey indicates that telecom executives are keen on the potential for AI to help them. More importantly, they see the technology as potentially having a direct ROI that can solve challenges to both the bottom line and balance sheets.

Some of the key opportunities, according to the survey:

- The industry is embracing generative AI (GenAI)

- Telcos see customer experience as the biggest opportunity for AI

- AI is already improving revenues and cost savings.

Challenges:

- Skill shortage is a major challenge to adopting and implementing AI

- AI investment has a limited budget

- Many respondents report difficulties in quantifying the ROI of AI.

Let’s look more deeply at some more of the results of the survey. The main takeaway is there is a sustained interest in adopting AI to help solve the problems of automating and improving services, especially among industry executives. In the 2023 survey, 90 percent of respondents reported they were currently engaged with AI, either at the assessment/pilot stage or at the implementation/using stage. Of those surveyed, 56% said that AI would be important to the company’s success. That figure rises to 61 percent among decision-making management respondents. That result is 14% higher than the 42% result in the 2022 survey.

GenAI for Telecom Advances

There also appears to be growing confidence that AI will help the industry’s competitive advantage in the market. In the 2023 survey, 53 percent of respondents agreed or strongly agreed that adopting AI will be a source of competitive advantage, compared to 39 percent in the 2022 survey. For management respondents, the figure was 56 percent.

When NVIDIA’s survey drilled into the top use cases and need for AI, GenAI rose to the top. Of those respondents investing in AI, 57% are using GenAI to improve customer service and support, 57% are using it to improve employee productivity, 48% are using it for network operations, and 32% are using it for marketing content generation.

When asked about specific goals, enhancing customer experiences was cited as a big AI opportunity for the industry, with 48 percent of respondents selecting that goal. Some 35 percent of respondents identified customer experiences as their key AI success story. Some of the specific use cases for customer experience include virtual assistance, enriched retail experience, recommendation engines, and management of customer churn.

Not everyone agrees, however. A minority of respondents said more work is needed to demonstrate how AI is addressing real-world business problems in the industry, says the report.

The survey found that the industry is even developing and deploying its own large language models (LLMs) for GenAI. Forty percent of the respondents said they are using their own data to train their own LLM model, which can be used to augment existing solutions.

Benefits on Revenue and Cost Side

There is a compelling case for AI to help on both sides of the business – both by controlling costs (increased productivity) and by helping boost revenues.

Among all respondents in NVIDIA's survey, 67 percent reported that AI adoption has helped them increase revenues, with 19 percent of respondents reporting more than 10 percent growth. For respondents in at least the trial or pilot stage, 71 percent reported that AI adoption has helped them increase revenues in specific business areas.

On the cost side, 63% of all respondents said AI has helped them reduce costs, with 14% noting the reduction was more than 10%. For those in at least the trial stage, 66% of respondents reported help in reducing costs.

Reflecting challenges in other industries, AI’s largest barriers for the telecom industry are likely to be a skills gap and lack of sufficient budget to deploy. A recent survey by Equinix showed that 62% of global decision makers see a skills gap as a threat to their business. In that survey, 42% of IT leaders doubt their ability to accommodate AI. The NVIDIA survey cited the lack of data scientists as critical to this skills gap, with 36% reporting that a lack of data scientists was a concern.

It’s interesting that NVIDIA is planting a stake in the ground – but the agenda is clear: Drive more demand for AI infrastructure. How will the industry implement it?

So What’s Next?

This telecom AIOps movement is big – but you have to ask what it’s going to mean for industry vendors. Improving customer experience seems like a laudable goal, but that is not likely enough to move the needle on the P/L side. The telecoms need a bigger lift. They need full network automation.

All of the major telecom suppliers are working on better solutions. Just a few examples include Microsoft in cloud infrastructure for telcos, Red Hat and IBM on the software side, and companies such as Amdocs on the Operations Systems and Support side (OSS).

A recent panel from TelecomTV highlighted AIOps for efficiencies.

“This is a must for telcos,” said Juan Manuel Caro Bernat, Director Autonomous Networks, Telefónica. “The world is changing. The services are more demanding. We have to change in agility, we have to be faster, we have to be better and make the network more intelligent. AIOps is a must. If not, we’re not going to be able to operate these networks.”

“AIOps is critical for our future,” said Beth Cohen, SDN Product Strategies, Verizon. Cohen said there are two flavors of AIOPs: Using it to automate basic operations such as monitoring; and machine-learning for applications awareness to promote self-healing.

In one example, Swisscom said they would invest more than $113 million US ($100 million Swiss Francs) in a partnership with NVIDIA to build new GenAI-powered supercomputers. Other providers have announced similar partnerships, including Softbank and NTT Docomo in Japan.

One debate in the industry is how the cloud providers will compete with traditional telecom vendors as well. For example, Microsoft has been making a huge push into the telecom market with its Azure for Operators platform, which supplies everything from 5G core services to customer experience and operations.

At MWC, Microsoft will be demonstrating Azure Operator Nexus, a hybrid cloud carrier platform that can run either in the Azure public cloud or on private infrastructure. This is designed to allay fears of telecoms putting all of their eggs in the public cloud basket, enabling them to hedge their bets between public and private cloud infrastructure.

Another area of focus emerging for AIOps is the radio access network (RAN) space, which is obviously a huge requirement for new services such as 5G and private wireless. These are capital-intensive areas of deployment for telecoms, and it requires more automation to handle the scale of new wireless services. In the runup to MWC, Nokia announced a partnership with NVIDIA to adopt the Grace Superchip to power its RAN services.

So, as you listen to the many telecommunications stories at MWC, it's probably best to ignore the hype about futuristic new services and drill into the practical example of how AIOps will help the industry in the short term. That's where it's most needed.