The SD-WAN Growth Report

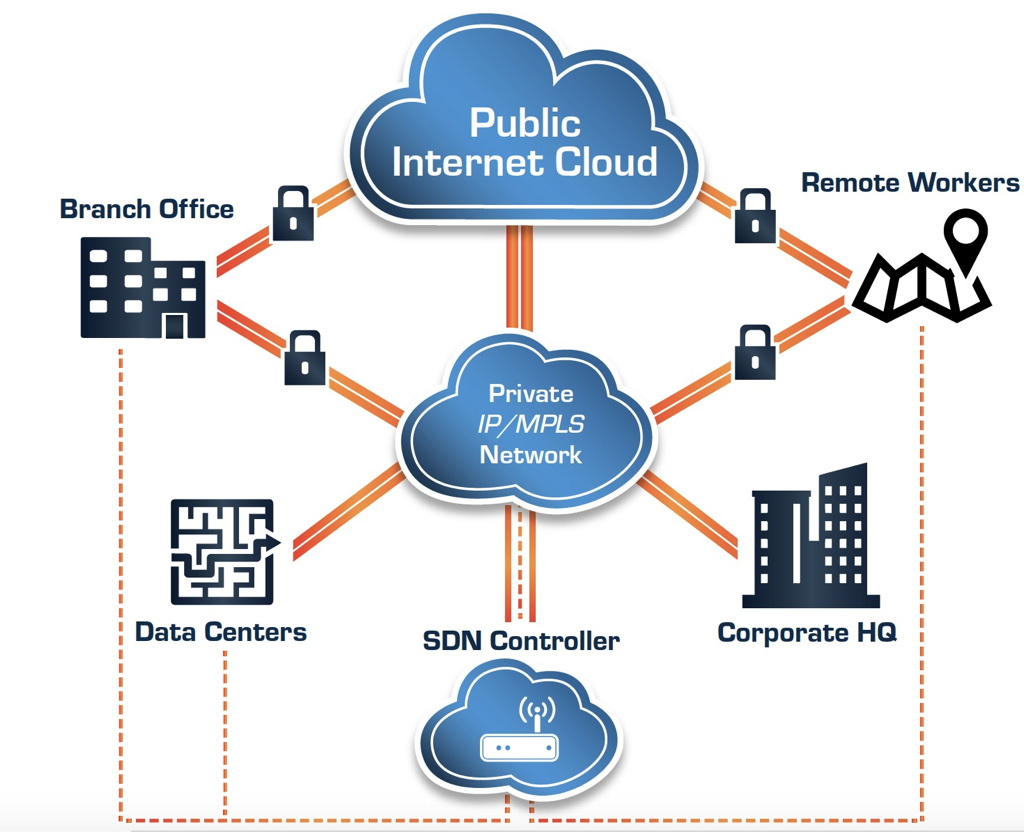

A revolution is happening in the way that enterprises buy and consume Information Technology (IT) services. It’s called cloud. Cloud is not only changing the way that consumers and business professionals purchase technology, it's changing the way networking connectivity is delivered. This is driving growth in in the software-defined wide-area networking (SD-WAN) market.

In August, 2017, we published the SD-WAN Growth Report as our latest premium research. The report details the major players, adoption rate, key features, and revenue growth rates of the SD-WAN market, which is one of the more attractive technology growth markets of 2017.

Some of the Key findings of the report:

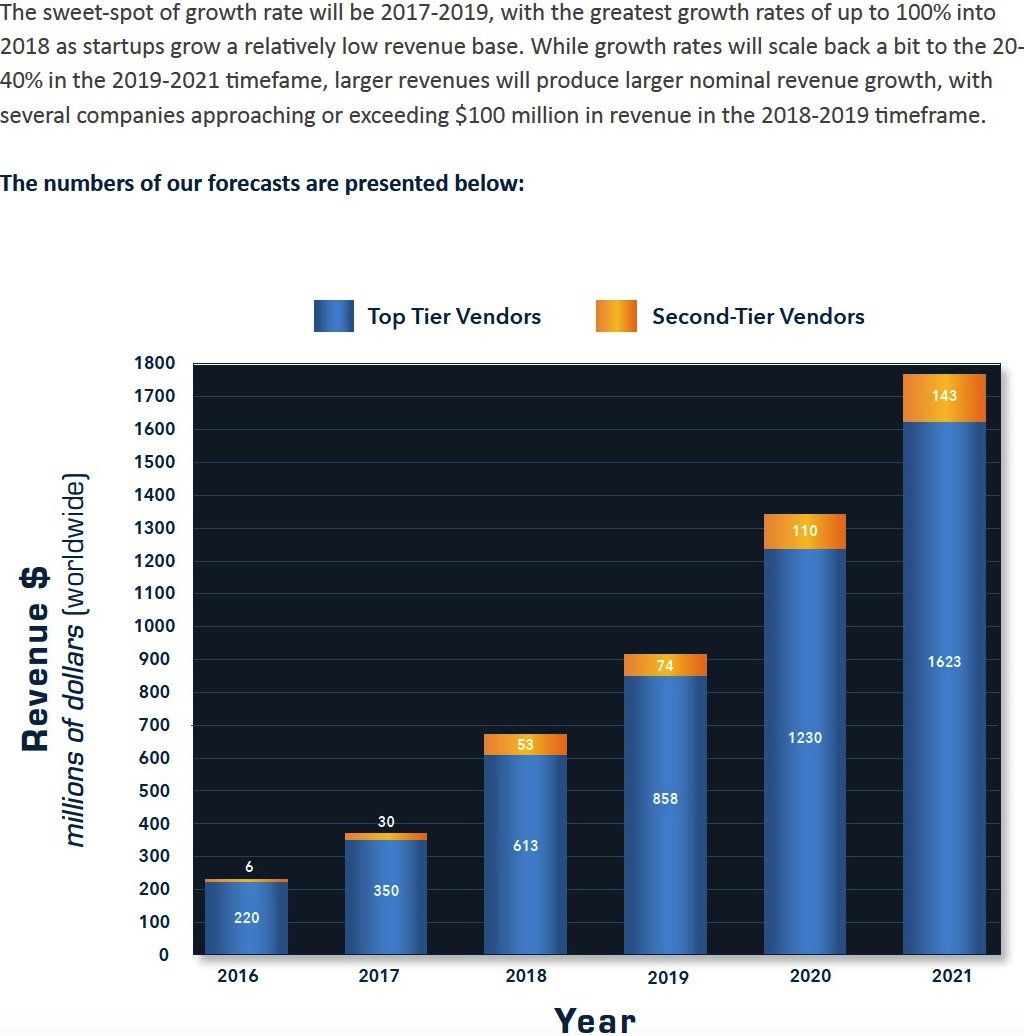

• Growth in SD-WAN technology tools and network-as-a-service (NaaS) revenues will exceed 30% annually for the next five years, accelerating to 75%-100% growth rates from 2017-2018. Our data gathering from both SD-WAN software and services players and industry sources indicates that enterprise demand for cloud-based WAN services is accelerating.

• Total SD-WAN tools and NaaS revenue will approach $1 billion by 2019 and will grow to $1.6 billion by 2021.

• At least four top SD-WAN NaaS and platform companies will approach or exceed $100 million in revenue in 2018. Futuriom estimates that the leading players vying for top Tier-1 revenue production include Aryaka, Cisco/Viptela, Cradlepoint, Fat Pipe, and Silver Peak.

• A huge shakeout in SD-WAN will happen in the 2017-2019 timeframe. Of Tier-1 vendors, which we define as annual revenue of more than $30 million, we expect three or four to achieve leadership status.

• At least two SD-WAN platform vendors will file for IPO in 2018. Futuriom believes that Aryaka, Cradlepoint, and Fat Pipe Inc. are the leading venture-backed startups that are closest to filing for an IPO. These companies as well as others are also likely to be acquisition targets by either service providers or large networking equipment vendors.

This new category of technology tools and services is expected to dominate growth in the market for enterprise communications services over the next decade. With SD-WAN, complexities in buying network services, such as configuring branch-office devices, routing schemes, and network addresses, is abstracted by software into the cloud and managed by the service provider, rather than the enterprise. In addition, service providers can bundle network management with connectivity, providing many opportunities in value-added services.

Companies included: Aryaka Networks, Cisco, Citrix, CloudGenix, Cradlepoint, FatPipe Inc., Huawei, Nuage Networks (Nokia), Silver Peak, TELoIP, VeloCloud, Versa Networks

Length: 28 Pages

Price: $595

Table of Contents and key images below.