Is Cisco Ready to Get Back in the M&A Game?

Some of you may have noticed we enjoy speculation about Cisco’s merger and acquisition (M&A) activity. It’s fun, not only because deals are fun but because Cisco is one of the most prolific buyers of companies in the networking, security, and cloud technology markets.

With the valuations of smaller tech companies falling across the board and Cisco's profits and balance sheet remaining strong, 2023 is looking like a good time to pull the trigger.

Will they do it? We will see. The chatter is out there -- but there was chatter all last year and nothing big happened. Perhaps falling valuations will now be the catalyst.

Why Has Deal-making Stopped?

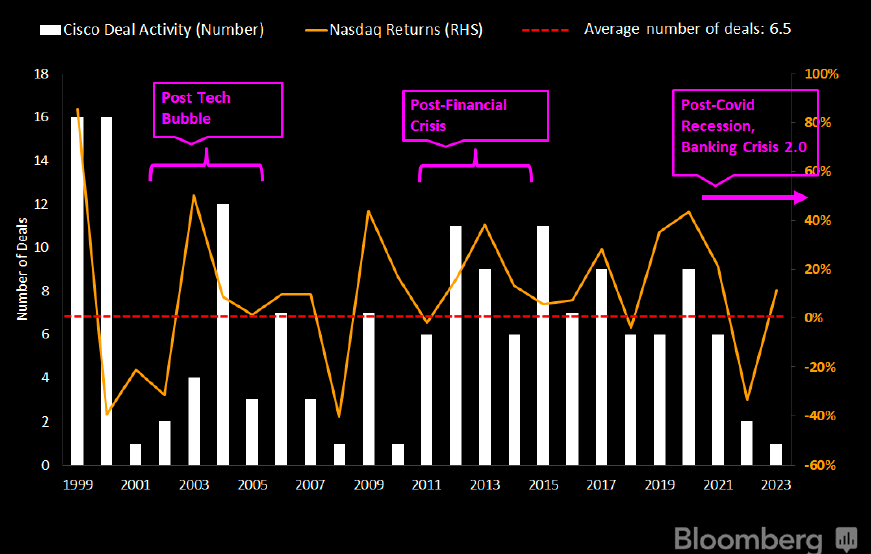

One thing that's shocking: Cisco's M&A activity has ground to a near halt. See the chart below supplied by Bloomberg Intelligence. Over the past two decades, Cisco has averaged 6.5 deals per year. Recently? Almost nothing.

Source: Bloomberg Intelligence

To access the rest of this article, you need a Futuriom CLOUD TRACKER PRO subscription — see below.

Access CLOUD TRACKER PRO

|

CLOUD TRACKER PRO Subscribers — Sign In |