Alkira Scores $100 Million Series C

Alkira has scored $100 million in Series C funding, bringing its total raised to $176 million. The vendor says it will use the funds to add more customers to its network-as-a-service (NaaS), advance its multicloud networking (MCN) portfolio, and add networking functionality for AI workloads.

The round is more evidence of enterprise demand for faster, more secure, and more efficient networking for hybrid cloud environments, a trend that Futuriom has been covering for years as part of our MCN practice and reports. It does seem like the market is heating up. Some of Alkira's top competitors include Arrcus, Aviatrix, Cato Networks, F5, and Prosimo. Cloudflare recently entered the MCN market by buying Nefeli.

Alkira has provided some interesting data about recent growth. Alkira says it has increased revenue 110% while doubling its roster of customers, which includes Chart Industries, Koch Global Business Solutions, S&P Global, Tekion, and Warner Music Group, to name a few. More than 20 of its customers spend more than $1 million annually with Alkira, management says.

Customers claim Alkira’s NaaS streamlines network configuration and simplifies network management, while offering security and MCN functions. “Now, we can connect any resource in any cloud and connect into the SD-WAN simply with Alkira, and we don’t have to redo our segmentation because it’s already there,” said Susan Tlacil, senior network architect at Chart Industries, as reported in an Alkira presentation.

Can the Khans Strike Again?

Alkira was founded in 2018 by CEO Amir Khan and CTO Atif Khan, who are brothers. The Khans were early innovators in the SD-WAN market at startup Viptela, where they came up with the idea of scaling virtual private networks (VPNs) by separating the network control plane from the data plane, which drove adoption of software-defined wide-area networking (SD-WAN) for enterprises to connect branches. The Khans are best known for selling SD-WAN pioneer Viptela to Cisco for $610 million in 2017.

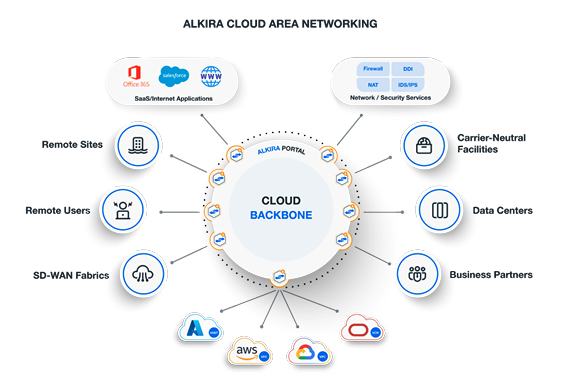

With its NaaS, which is based on points of presence (PoPs) in public cloud infrastructure, Alkira offers a “digital design canvas” customers can use to quickly generate network connections across multiple clouds. Its network works with AWS, Google Cloud Platform, Microsoft Azure, and Oracle Cloud in a system the vendor terms Cloud Area Networking (CAN).

Source: Alkira

Alkira offers a range of applications for the NaaS, including cloud firewalls, network segmentation, zero-trust network access (ZTNA), and MCN. It can manage Border Gateway Protocol (BGP) and routing in the cloud, giving customers a secure VPN that unlike SD-WAN doesn’t use MPLS or the Internet. Customers get one consolidated bill for cloud networking services.

Alkira augments its applications with a range of functions offered via a growing ecosystem of partners. Itential, for example, has joined its Automation Platform to Alkira’s NaaS with application programming interfaces (APIs) that provide a way for joint customers to create multicloud network configurations and then orchestrate and manage them for consistency and security. Alkira’s network also features integrated security from Palo Alto Networks (PANW) and observability from Kentik, among other solutions.

The MCN Market Picture

Alkira competes with a range of MCN players. Of the aforementioned competitors, Aviatrix, F5, and Prosimo are probably the closest, because they focus on delivering application performance and network security across clouds.

However, all of these companies have important differences. For example, Aviatrix targets large enterprises that want to integrate their legacy networking infrastructure with multicloud connectivity, and it also provides its own security software, with its Distributed Cloud Firewall. Alkira packages security software from partners such as Palo Alto Networks in its NaaS approach. F5 and Prosimo are focused on application-layer security and performance. By positioning as a NaaS provider, Alkira differentiates itself from platforms such as Aviatrix’s, which offers a broad platform for large customers who want to build and control their own networks.

Artificial intelligence are also having an effect on Alkira’s market approach, as it is influencing all networking decisions. Plans are underway to offer connectivity to AI services as well as within private AI networks (networking for AI). AIOps features are also in the works (AI for networking). Exactly how this will play out remains to be seen, but if Alkira can jump into the AI networking trend it could help further solidify its market position with enterprise customers.

Alkira’s Series C was led by Tiger Global with participation from existing investors Sequoia Capital, Koch Disruptive Technologies, and Kleiner Perkins and input from new investors Dallas Venture Capital, NextEquity, and Geodesic Capital.