AI-RAN Alliance, With Microsoft and NVIDIA, Tackle AIOps

It was Day 1 at Mobile World Congress in Barcelona, and the AI operations (AIOps) movement for the telecom industry gathered significant momentum.

A group of powerful cloud providers and vendors today announced the AI-RAN Alliance, which is looking to use AI and powerful compute platforms to drive more efficient operation of the radio access network (RAN). The idea is that a modern and AI-driven RAN architecture can drive down operational costs.

As we pointed out last week, the largest global service providers are experiencing slowing revenue growth and mounting costs, so they see generative AI (GenAI) as a technology to drive AIOps and help reduce operating costs with automation.

Hyperscalers, NVIDIA Moving In

One notable takeaway of the AI-RAN Alliance is the growing influence of AI superpower NVIDIA, as well as cloud providers Amazon Web Services (AWS) and Microsoft. In separate news, Microsoft announced a collection of updates to its Azure for Operators platform, including many AI-driven features for optimizing carrier networks and delivering AIOps.

The Alliance's founding members include AWS, Arm, DeepSig Inc. (DeepSig), Ericsson, Microsoft , Nokia, Northeastern University, NVIDIA, Samsung Electronics, SoftBank Corp., and T-Mobile USA.

The alliance does include traditional telecom suppliers such as Ericsson and Nokia, and Nokia announced its own partnership with NVIDIA last week. But it's clear that with AI on the rise and hybrid cloud platforms becoming more important, the center of gravity of telecom infrastructure is shifting toward AI and cloud, which should benefit those suppliers.

There are also a few notable companies missing from this list: Google, Cisco, VMware, and Red Hat. Google has been pursuing the telecom opportunity, but its omission with AWS and Microsoft included may raise eyebrows. VMware and RedHat also have platforms for telecom deployments, but those are more focused on the software side, and VMware is currently being subsumed into new owner Broadcom. Cisco sells telecom infrastructure, but with telecom industry bookings down some 40% in its last earnings announcement, it looks like it's pulling back from that market.

Why are AWS and Microsoft on this list but not Google? And why no Cisco, Red Hat, or VMware?

The group says its mission is to enhance mobile network efficiency, reduce power consumption, and retrofit existing infrastructure, setting the stage for unlocking new economic opportunities for telecommunications companies with AI, facilitated by 5G and 6G.

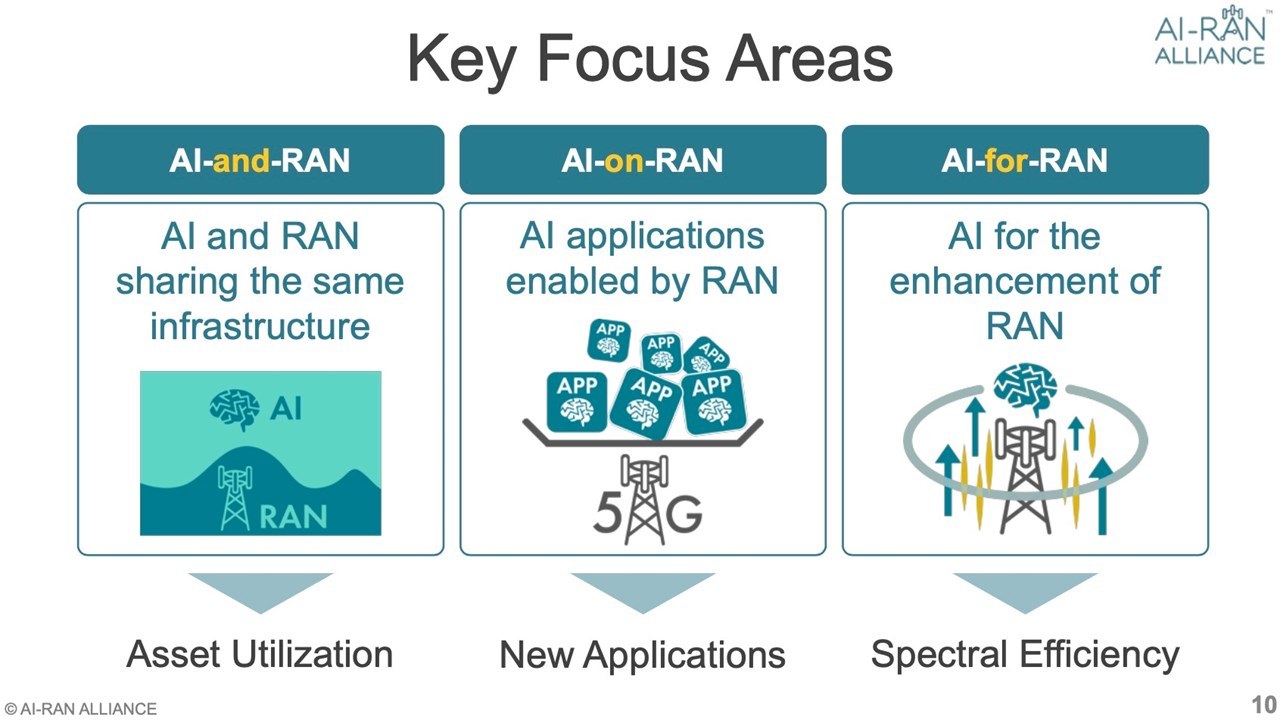

According to the AI-RAN Alliance, the group will target these areas:

- AI for RAN – advancing RAN capabilities through AI to improve spectral efficiency.

- AI and RAN – integrating AI and RAN processes to utilize infrastructure more effectively and generate new AI-driven revenue opportunities.

- AI on RAN – deploying AI services at the network edge

Looking for an AI Edge

The message is clear: Cloud operators and AI infrastructure providers see a huge opportunity in the mobile network, as billions of dollars in systems are being deployed for modern services such as 5G. The component vendors in the alliance, NVIDIA and Arm, also see a lot of potential to move modern AI architecture into telco deployments.

In the near term, it’s not likely that the telecoms are positioned to benefit from AI on the services growth side. But they can use AI in operations – AIOps – to increase automation and reduce costs.

Some of this was presented in an extensive telecom industry survey from NVIDIA. Data from the State of AI in Telecommunications Survey indicates that telecom executives are keen on the potential for AI to help them. More importantly, they see the technology as potentially having a direct ROI that can solve challenges to both the bottom line and balance sheets.

As a recap of some of the key opportunities, according to the survey:

- The industry is embracing generative AI (GenAI)

- Telcos see customer experience as the biggest opportunity for AI

- AI is already improving revenues and cost savings.

Challenges:

- Skill shortage is a major challenge to adopting and implementing AI

- AI investment has a limited budget

- Many respondents report difficulties in quantifying the ROI of AI.

Futuriom Take: NVIDIA and other AI-RAN Alliance members are clearly placing big bets on the mobile market to drive demand for AI infrastructure. This announcement puts significant momentum behind AI for RAN and addresses one of the more expense-intensive areas of the telecom infrastructure.