SASE Ecosystem Growth: What to Expect in 2024

The secure access service edge (SASE) market represents the next generation of network security, combining the features of network-based security and application awareness with cloud-based management of services. SASE emerged as an outgrowth of the software-defined wide-area networking (SD-WAN) technology movement, which made it easier for organizations to configure, orchestrate, and manage WAN connectivity from enterprise branches.

SASE has so far been a successful market for many participants, but it’s complicated. Like SD-WAN, it focused on delivering end-user services, rather than equipment and software. Many SASE services are delivered with a software-as-a-service (SaaS) or a network-as-a-service (NaaS) model, which makes them easier to consume. But larger enterprises buy SASE platforms from vendors to build and deliver their own network services to employees or customers. So, the flavor of the SASE deployment is going to depend on the buyer.

Overall, SASE is about building more visibility, analytics, and automation into the network. Just as SD-WAN was used in network analysis to distinguish among cloud applications to allow policy-based networking and access, SASE takes this a step further to tie in integration with cybersecurity functions.

Download the report here now!

About This SASE Report

We are heading into the seventh year of Futuriom SASE market reports, where we correctly identified this as a key growth market almost a decade ago. This report is intended to give you a background on what has happened in the SASE market over the past year, along with information on the trends set to carry it into 2024. We expect the SASE market to attract as much attention as ever, as networking companies, security companies, and cloud-based NaaS companies battle it out for mindshare among enterprises.

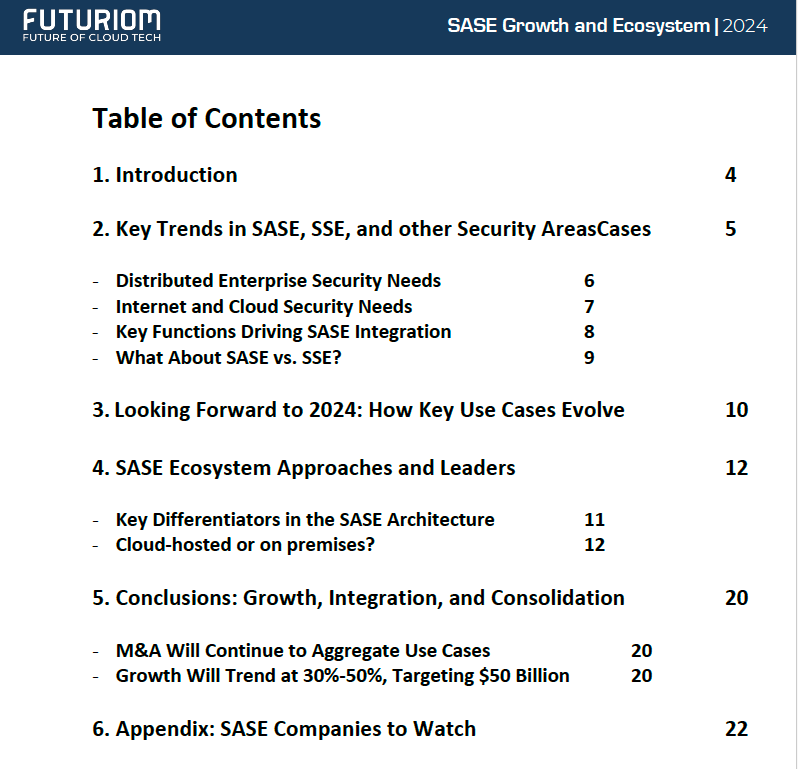

In this report, we cover key trends in SASE, secure service edge (SSE), and other converged network security use cases such as zero trust network access (ZTNA). We'll look at how these trends are evolving over the years. We also examine the enormous SASE ecosystem and how different participants are differentiated. The table of contents can be seen below.

This report was supported by the sponsorship of Aryaka Networks, Cato Networks, and Versa Networks.

Key Highlights

Some of the key highlights of the report include:

- Futuriom believes the secure access service edge (SASE) market is in the early innings of a long-term shift helping cybersecurity pros consolidate distributed cloud security. Our 2023 survey work as well as interviews with end users indicates they would like to converge network, cloud, and edge security using SASE.

- The cybersecurity market is slowing a bit, based on recent public reports. CEOs on recent earnings calls have referenced enterprise slowdown and slower deal movement. Futuriom believes a general enterprise cybersecurity slowdown to a 20%-30% annual rate driven by “cost optimization” will last into the 1H of 2024.

- Technologies for SASE, zero trust, and multicloud networking are converging. SASE represents a movement toward distributed security and networking – including cloud security -- that is driving a convergence of networking, zero trust security, and cloud security. This may also be driving cost optimization, as enterprises look how to best consolidate networking and security tool spend.

- Consolidation is expected to continue. With many large acquisitions taking place in SASE areas, including cloud access security broker (CASB) and zero trust network access (ZTNA), expect this trend to continue as larger players roll up best-of-breed security functions into their SASE portfolios.

- Companies mentioned in this report: Akamai, Aryaka Networks, Cato Networks, Check Point Software, Cisco, Citrix, Cloudflare, Elisity, Enea, Forcepoint, Fortinet, HPE (Aruba), Juniper Networks, NetFoundry, Netskope, Palo Alto Networks, Versa Networks, VMware, Zscaler.