Is Intel's Secret Weapon 5G?

When Pat Gelsinger, the new CEO of Intel, (INTC) delivers a business update on March 23, it will be no surprise to hear an emphasis on 5G. Over many months, Intel has steadily if quietly worked to increase its footprint in nearly every area of the next-generation wireless telecom infrastructure, including the 5G network edge. where its gradual encroachment has been evident for more than a year.

The direction is well taken. Intel’s market stumbles in recent times are well documented, particularly in manufacturing, where processes have fallen behind trends, delaying deliveries and creating distraction. By throwing its hat into the 5G ring, Intel has made inroads that could boost its role in the world’s hottest tech markets if, as investors hope, Gelsinger and company manage to resolve some of the fabrication issues.

Telcos Rule Intel’s Strategy

Intel’s work in 5G has several aspects, including components for 5G chips, work on 5G projects with telcos, and investment in 5G startups. In each of these areas, however, the emphasis is on supplying service provider networks.

Regarding components, Intel offers its Xeon Scalable processors and Xeon D processors; the Intel vRAN Dedicated Accelerator ACC100; open reference architecture FlexRAN for virtualized, open radio access network (RAN) implementations; an Atom P5900 processor for 5G base stations; and a range of other silicon/software solutions.

Many of these have been trialed with various telcos, including the following;

Deutsche Telekom: Early last year, Intel teamed with VMware (VMW) to create a virtualized, open RAN (O-RAN, per the standards group O-RAN Alliance) for Deutsche Telekom (DT). Designed as an experiment, it’s not clear how the project played out in DT’s network, but the telco has said it intends to roll out O-RAN service this year.

Rakuten Mobile: The Japanese telco developed a fully virtualized 5G-capable network in part by basing equipment and core elements on Intel processors. Rakuten uses the virtualized elements for its service today, which offers 5G in several areas of Japan and also runs 4G LTE. Wider availability and standalone 5G are scheduled for this year.

SK Telecom: The South Korean carrier has formed an alliance with Intel, Hewlett-Packard Enterprise (HPE), and Samsung to virtualize network functions in its 5G infrastructure. The deal is aimed at easing the rollout of 5G services involving augmented reality (AR) or virtual reality (VR).

T-Mobile: Intel, along with the U.S.’s NASA, helped the telco open a 5G test lab in Seattle last year. The lab continues to expand, with its third round of startup participants to start work soon. While the lab’s work hasn’t been cited in specific services from T-Mobile (T-MUS), it has propelled a lengthening list of innovative early-stage startups that could contribute significantly later on.

Verizon: Last summer, Intel, Samsung, Wind River, and Verizon (VZ) announced a fully virtualized 5G data session trial on Verizon’s commercial network. Intel contributed Xeon processors, acceleration cards and Ethernet adapters, along with the FlexRAN vRAN technology to the project.

Other Intel 5G Efforts Underway

If all of the above isn’t sufficient proof of Intel’s commitment to 5G, there’s a recently announced deal with Google Cloud aimed at developing reference architectures for telcos. Given Google’s alliances with a growing roster of carriers, including AT&T (T), DT, Lumen (LUMN), NTT, Orange (ORAN), Rakuten Mobile, Telefonica (TEF), and Telus (TU), the alliance could open more 5G doors for Intel.

The deal with Google is evidence that Intel also has its eye on multi-cloud networking, which will advance in popularity as 5G emerges. For years, AWS has touted Intel as a partner in enabling cloud service performance. Intel is also entrenched in Microsoft’s Azure ecosystem.

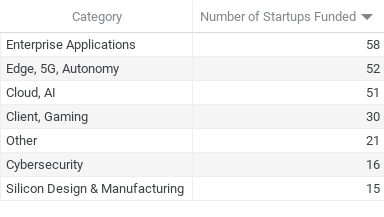

Intel also is investing in 5G through its Intel Capital venture arm. Of the group's stated six major focal points for startup investment, the “Edge, 5G, & Autonomy” ranks second to “Enterprise Applications” in having the biggest portfolio, as shown in the table below:

Source: Intel Capital

Given all this, 5G seems to be a star to which Intel has hooked its wagon. And there’s no time to lose. Intel faces competition from many suppliers in this area, including Marvell (MRVL), which has launched its own set of 5G components. Arm is involved in 5G. NVIDIA (NVDA) has a strong position.

Intel has its challenges. But its investment in 5G is slowly emerging as a potentially sizable asset. Now let’s see what Pat Gelsinger has to say.