Futuriom's New CTP Report: Telcos and Hyperscalers: Who Has the 5G Edge?

Despite market vagaries prompted by rising costs, supply chain woes, and geopolitical unrest headed by Russia’s invasion of Ukraine, public cloud services continue to grow. In the wake of the COVID-19 pandemic and the trend toward remote work, more enterprises are shifting their workloads cloudward.

In the midst of this progression, 5G services are emerging to spur the performance of cloud-native applications, particularly at the network edge. The speed and latency improvements of 5G also are boosting the popularity of private wireless services across a range of enterprises.

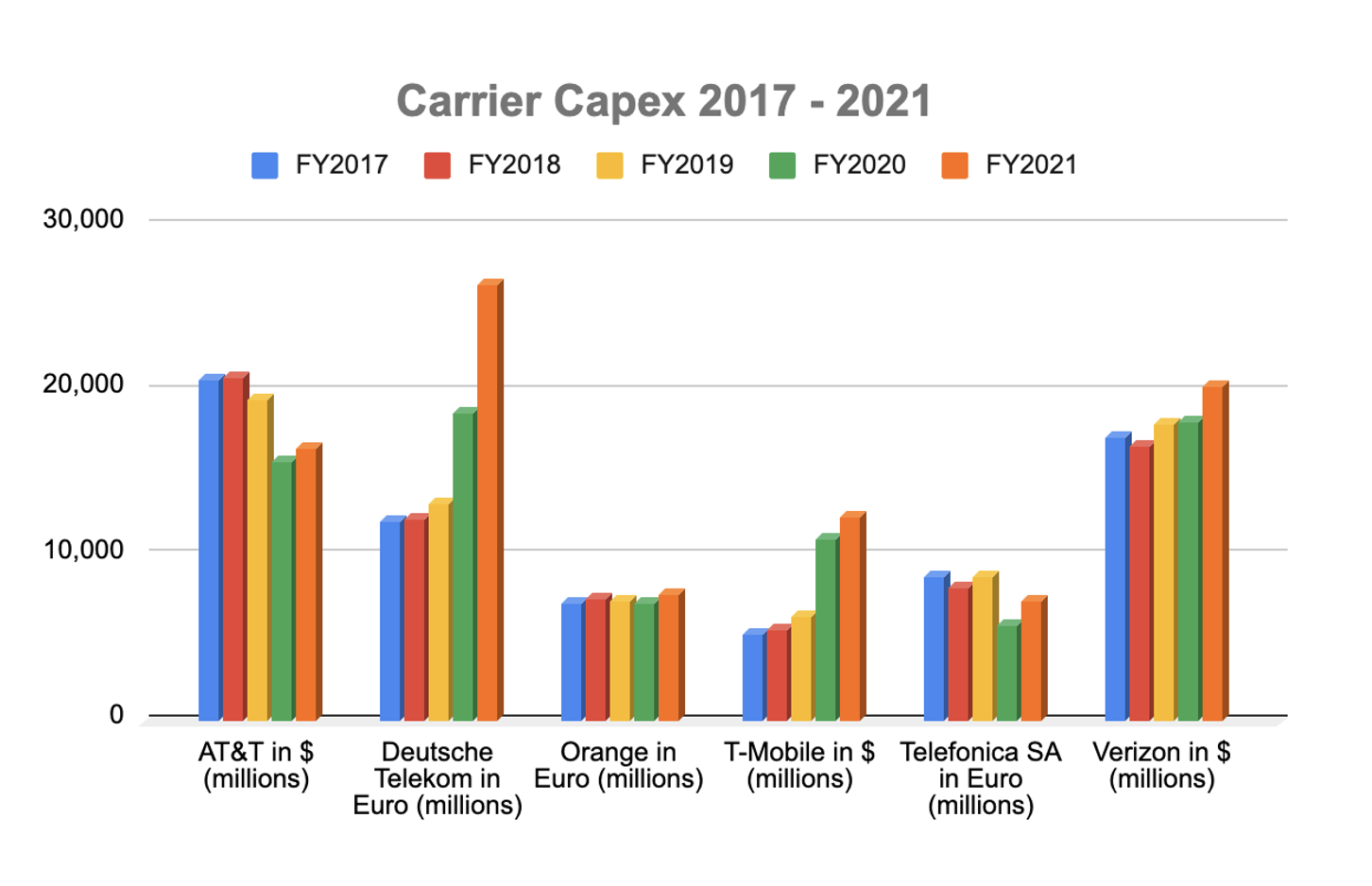

In Futuriom’s latest 5G Edge Cloud Tracker, we unpack these trends, analyzing telcos’ capital spending and investment in 5G, along with hyperscalers’ spending patterns over the past year.

The results show that, while telcos and hyperscalers continue to hew away to get 5G on track, enterprises are chomping at the bit for the kind of edge performance they’ve been promised.

Source: Company reports

This new report is the latest from our new premium technology research service, Cloud Tracker Pro (CTP), which offers detailed quantitative and qualitative analysis of the technology expansion in the cloud infrastructure markets. (For reference, see our first issue exploring levels of capital spending by worldwide telcos here; and our second issue, exploring the state of B2B applications at the 5G edge here.)

Report Highlights

Telcos continue to roll out 5G, though only a handful of services based on the massive C-band spectrum purchases of 2020 have made it to market. Meanwhile, despite the spending, 5G services aren’t quite up to the level enterprises are demanding. Meanwhile, hyperscale cloud providers have an eye on the edge as the focal point for performance improvements launched by 5G availability.

Following are some of the findings we’ve unearthed in exploring these issues over the past 12 months:

--- Despite 5G progress, actual performance is more like 4G, at least in the U.S. Tests show that 5G rates in the U.S. don’t always differ significantly from 4G, apparently due to a lack of sufficient cell-tower and fiber infrastructure.

--- Hyperscaler cloud providers continue to grow sales substantially. But not all of them show a profit. AWS and Azure make money, but Google Cloud Platform operates at a loss.

--- Enterprises are demanding edge services as part of 5G. Hyperscalers and telcos are aggressively trialing multiple solutions to bring power to the enterprise edge as 5G services roll out.

--- Edge apps for 5G networks are taking many forms. The key applications on our radar include factory automation, retail analytics, computer vision, and private wireless.

--- Telcos are emerging as the key providers of managed 5G edge services. Telcos appear to have the advantage when it comes to marketing and supporting complex edge services based on combined hyperscaler/telco technologies.

Cloud Tracker Pro subscribers can download the full report, which is part of our series of quarterly reports plus additional bonus premium analysis that subscribers receive throughout the year. Click on the button below to subscribe.