Does an HPE-Juniper Deal Make Any Sense?

Today, news outlets are reporting that Hewlett Packard Enterprise (NYSE: HPE) is in final talks to acquire Juniper Networks (NYSE: JNPR). But with shares of HPE falling 7.7% in the market today, it may add to questions about the viability of the deal.

HPE likely sees the benefit of Juniper’s AI software technology, including Mist and Apstra, which can be used to improve enterprise networking operations. They could also use the Juniper portfolio to tie into hybrid cloud sales efforts. But the numbers are challenging to make the deal work, and despite the likely marketing message around AI, the deal would end up making HPE more of a networking and hardware company. There would also be challenges in overlap with HPE’s Aruba Networking division.

Or, it could also just fail. The vast majority of larger mergers fail, according to most studies as well as the Harvard Business Review. Mostly due to politics and bureaucracy. This deal smells like AOL/Time-Warner or perhaps AT&T/DirecTV. For those keeping score, we called AT&T/DirecTV correctly.

Related Articles

Why Aryaka's Unified SASE Is Important

Aryaka rolls out Unified SASE, looking to provide a complete network and security platform

Arista Credits Enterprise and Edge for EarningsExecs say strong enterprise sales and an eye to the campus edge are driving improved financials.

How 10 Telcos Are Getting AheadWhile other telcos struggle with legacy infrastructure and 5G disappointment, these 10 are pivoting to transformation

Let’s dive into each component.

(Update: The deal was announced after the market closed on January 9th. The deal price was $14 billion. After looking at the investor deck, we have softened our stance a bit and you can read an update on Forbes.)

The Numbers Are Challenging

First off: The numbers on this deal are big and kinda crazy. The reported bid by HPE is $13 billion, according to the Wall Street Journal and Reuters. It would be primarily financed with debt. That's probably the part HPE shareholders don't like -- the prospect of adding $10-$11 billion in debt to the balance sheet. The pop in Juniper’s stock (22%) today has brought it up to $11.7 billion, closing the gap with the reported number - but the $13 billion bid would represent nearly a 30% premium over Juniper's share price on Monday. HPE’s market capitalization is $21 billion, meaning it’s committing more than half of its market capitalization to acquire Juniper. Meanwhile, HPE has $29 billion in sales, nearly six times Juniper’s $5.6 billion in sales.

Let me put it this way. Imagine you own a pizza shop doing $2.9 million in sales and worth $2 million. Would you buy a similar pizza shop down the street doing $580,000 in sales, for a price of $1.26 million? By raising $1 million of new debt? That's basically the deal here. They are paying more than two times Juniper's sales with debt.

When the deal is looked at from the numbers perspective, it looks like a merger more than an acquisition. And it's a merger in which the much smaller company may have as much power as the larger company. in those terms, it makes sense that shareholders might not like it. Would a merger be enough to change each company’s trajectory? Neither company has been growing. Juniper’s revenues have been flat over the past several quarters. HPE hasn’t grown in five years. In other words, both companies have been stuck and they are looking for a catalyst to move forward.

As one prominent Silicon Valley networking executive told me, under condition of anonymity:

"Tying two rocks together does not make them float. The thesis makes sense -- compute, networking, and security are coming together. But these companies are filled with bureaucrats. They won't execute."

The rationale of the HPE management is likely “synergies” – i.e., cut redundant staff in areas such as corporate and marketing, and presto, you have a more profitable company. This makes sense on some level, but is it worth sacrificing more than half the company’s equity for this? Not only that, but news reports say that much of the deal would be financed by debt, increasing the leverage and risk for HPE.

I’m sure the beancounters will crunch the numbers and show that HPE will add to earnings by buying Juniper. But why are the shareholders protesting so much? It’s because this deal sends a message that after years of stagnant growth, both companies are getting desperate.

Strategic Misfits

Strategically, the deal is also problematic. A combination with Juniper would pull HPE in the direction of being a traditional networking equipment provider, while it has been attempting to pivot to cloud services. Juniper has been making more noise about being a cybersecurity and software player, but let's face it: The company is still largely a networking equipment provider, and that's how Wall Street sees it.

HPE still has the problem of "what is HPE?"

This would contradict HPE’s recent efforts to position itself as a cloud service provider, with its highly marketed GreenLake concept. One potential angle is that HPE sees using Juniper’s software products, such as Mist and Apstra automation tools, as a position for AI services for enterprise. That’s fine, but if Juniper has struggled for years to show that these products are large enough to move the needle on its relatively small scale, how would it move the needle for HPE, which has $29 billion in sales?

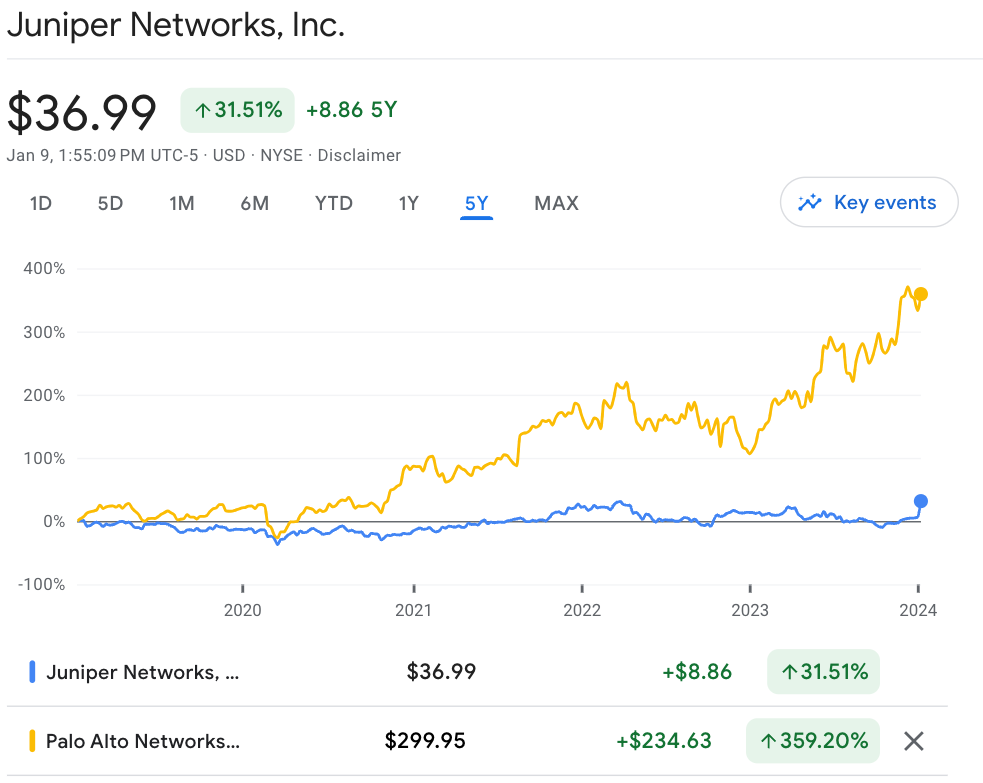

This also casts more doubt on the Juniper growth story, which years ago was linked to cybersecurity, a market where there is a lot of growth. That strategy has largely failed, as Juniper is still not perceived to be a leader in cybersecurity, and competitor Palo Alto Networks (Nasdaq: PANW) has shown immense gains during this period. Over the past five years, Palo Alto Networks shares have climbed 360% while Juniper's shares have climbed only 32%, badly trailing the returns of the S&P 500.

Source: Google

Synergy Could Mean Overlap with Aruba

Synergy is also a two-edged sword. You can remove redundant operational staff, but you may also have an overlap problem: selling the same product to the same customers. This would certainly be a challenge for HPE’s Aruba Networking division, which targets the same enterprise networking market as Juniper.

Aruba has been one of HPE's strongest-growing segments. It includes elements of SD-WAN as well as secure access service edge (SASE). But these are also core elements of Juniper's products - and both companies still play second fiddle to industry giant Cisco (Nasdaq: CSCO).

Overall, it’s very hard to see how this improves HPE’s capabilities in cloud or Juniper’s capabilities in the enterprise. There's direct overlap of competing product lines. It also lends question to the strategic direction of HPE – recently positioned as a cloud services provider for enabling hybrid cloud. With Juniper, HPE looks more like a traditional networking company still trying to catch up with Cisco. Is that the growth market to be pursuing? All the numbers indicate that network enterprise has been a static market. Even Cisco has had challenges growing.

Yes, they might be tying together two rocks to hope they float. Or as somebody else wrote me, It could be like two dinosaurs mating.

Related Articles

Arista Credits Enterprise and Edge for Earnings

Execs say strong enterprise sales and an eye to the campus edge are driving improved financials.

Cisco Drops on 'Uncertainty,' Layoffs to ComeCisco reported reduced product and services revenues, citing slow telco sales. As a result, the company reduced guidance and plans a 5% companywide layoff

Aviatix Valuation Soars on New FundingAviatrix has raised $200 million in Series E funding, bringing its valuation to $2 billion, up from $700 million in February 2021