Cisco Drops on 'Uncertainty,' Layoffs to Come

Cisco (Nasdaq: CSCO) delivered no valentine on its earnings call last night. The company will cut 5% of its workforce amid a restructuring to cope with reduced demand from key telco and service provider customers. Cisco also reduced its guidance and cautioned that it may take at least two quarters for demand to pick up.

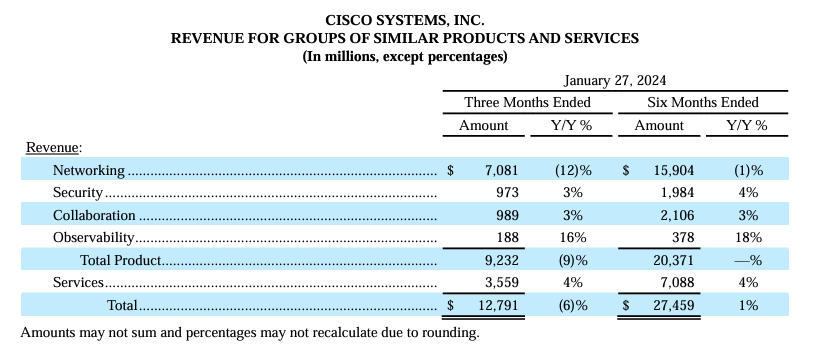

The big picture: The company is shrinking on falling orders, with revenue down 6% year-over-year (y/y). Cisco shares this morning traded down $1.26 (2.5%) to $49.01 on the news.

“This industry has seen significant pressure, and they are adjusting deployment phasing, which is weighing on our business outlook,” said Cisco CEO Chuck Robbins on the company’s earnings call. “Given these factors, we are adjusting our expenses and investments to reflect the current environment.”

Related Articles

Is CoreWeave Eyeing an IPO?

CoreWeave's advertising for an investor relations director and SEC expert. Could an IPO be in the works?

Aviz Updates Network Stack with AIAviz Networks has upgraded its SONiC network platform with AIOps capabilities using GenAI

Why Cisco Bought SplunkCisco finally gets its Splunk prize -- but is the SIEM market healthy?

Executives cited macroeconomic uncertainty, a longer “digestion” period for networking equipment, and weak demand from telco and cable customers as leading to the planned job cuts. As of July 29, 2023, Cisco had 84,900 employees, signaling that over 4,000 jobs will be eliminated. The company plans to take a pre-tax charge of about $800 million as part of the restructuring.

When will the spending slowdown end? Management made no commitments beyond being “hopeful” that in 2025 things will pick up again. But: “I will say that we think that the consumption of the elevated inventory levels should be -- we should be through that by the end of our fiscal year [July 2024],” said Robbins.

Stumbling Blocks and Opportunities Ahead

Amid the gloomy outlook, Cisco reported $12.8 billion in quarterly revenue, down 6% year-over-year. Adjusted net income was $3.5 billion and adjusted earnings per share (EPS) was 87 cents. Gross margin was 66.7%. The company is guiding to $12.1 billion to $12.3 billion next quarter, with adjusted EPS of 84 to 86 cents and adjusted gross margin of 66% to 67%.

Revenues from networking were down significantly, and sales of all products were down 9%, with sales of services down 6%. At the same time, observability, which was prominently displayed in new product announcements at last week’s Cisco Live event in Amsterdam, grew 16%.

Source: Cisco press release.

Cisco remains focused on AI and software, particularly in the area of observability, and it plans to close its $28 billion acquisition of data management software provider Splunk as early as this quarter. Still, it may be a while before AI starts to make a dent in the financials. “We also continue to capitalize on the multibillion-dollar AI infrastructure opportunity,” said CEO Robbins last night. But he also said: “While there is tremendous opportunity ahead, we are still in the early stages of adoption of AI workloads.”

Interestingly, Cisco doesn’t see its success in AI depending solely on its recently announced integration deal with NVIDIA. Orders for AI-related products have tripled within the past 90 days, Robbins said, and all that is independent of NVIDIA.

At least one analyst on last night’s call wondered about security. Why isn’t it growing faster? What can be done to fix that? New products are getting traction, said Robbins. He cited Cisco XDR (announced last April) as gaining 230 customers. “That's going to be a real important integration point with Splunk, by the way,” Robbins said. Also, with Cisco Identity Intelligence announced last week, the company boasts that it's breaking ground in unifying networking, identity, and security.

Cisco also recently announced support for Kubernetes observability on its Full Stack Observability (FSO) platform via extended Berkeley Packet Filter (eBPF) technology. Cisco’s planned purchase of Isovalent, which specializes in the technology, should bring further security and monitoring to Kubernetes clusters.

One analyst questioned whether Cisco sees any opportunity related to the merger of HPE and Juniper Networks. Robbins had this to say:

“So, I would say on the HP Juniper deal, the one area where they have meaningful overlap is in wireless and I don't know if there's any connection to the fact that we had a 50% increase in $1 million-plus wireless deals sequentially. So, it's hard to say. I mean, there is a lot of noise in the system or in the industry about what they do there, but I can't say specifically that any customers have talked to me about it, to be honest.”

Cisco shares were trading at 48.90, down 1.38 (-2.74%) this morning.

Futuriom Take: Cisco’s financials point to an ongoing pullback in capital spending by telcos and enterprises. Forward success will depend heavily on Splunk, which could boost observability and security, helping to grow revenue as the company waits out the downturn.

Related Articles

AI Traffic Is Up, and So is Security Risk

Security platform provider Zscaler says enterprise users are diving into AI applications - and facing new AI cyberthreats

Cloud Native Climbs at KubeConCNCF takes on AI -- and much more

Aviatrix Adds Observability API in Cloud-Native PushAviatrix adds Network Insights API, which will help networking practitioners integrate with common observability tools