The 2018 SD-WAN Growth Outlook Is Here!

Networks are more important than ever, connecting consumers with digital content and enterprise users with critical business applications. Software-defined wide-area-networking (SD-WAN) technology represents a step forward in building adaptive networks to suit these needs while lowering operating expense (opex).

As bandwidth demands soar from both consumer and business needs, businesses are looking for better ways to manage, route, and secure the bits. SD-WAN enables network managers to plan network needs with software-based design and configuration that can be changed and managed centrally. It also enables IT and network staff to leverage growing broadband Internet capabilities to lower the cost of opex.

Futuriom's new report, the 2018 SD-WAN Growth Outlook, details the trends that are driving SD-WAN technologies into the market as well as the SD-WAN products and services that enable this application-aware, adaptive WAN.

Findings in the SD-WAN Growth Report

We spent months analyzing the market, talking to dozens of sources at enterprises, service providers and technology companies. The report covers the development of SD-WAN technology strategies and investment, including how fast you will see this technology grow in the market.

Some key findings in the report:

• Growth in the SD-WAN market is now accelerating. SD-WAN technology is receiving broad market acceptance as enterprises see direct return-on-investment in implementing cloud-managed WAN.

Related Articles

2024 SD-WAN/SASE Managed Services Survey Report

See what end users are looking for from SASE/SD-WAN services, according to our 2024 survey of 192 experts

ZTNA Trends and Leaders 2022Our second annual ZTNA report covers the leading trends and companies in this popular cybersecurity technology category

Why AWS Private 5G Will Stir Up the Enterprise MarketAWS Private 5G models an ideal way for enterprises to adopt the technology while raising interesting questions about ecosystem go-to-market strategies

• The top drivers of SD-WAN growth are service agility and opex cost savings including bandwidth costs.

• Futuriom expects the market for SD-WAN tools and network-as-a-service (NaaS) revenue (non-legacy service provider) to reach $1.5 billion by 2019 and $2.5 billion by 2021. Our data was gathered from both SD-WAN software and services players and industry sources.

• At least three SD-WAN platform and NAAS vendors could exceed $100 million in annual revenue in 2018. The vendors most likely to do this are Aryaka, VMware/Velocloud, and Silver Peak.

• Many of the private SD-WAN companies are gaining momentum and have potential for an initial public offering (IPO) or major acquisition in the next few years. The leading candidates include Aryaka, Cato Networks, Cradlepoint, FatPipe, Silver Peak, and Versa Networks.

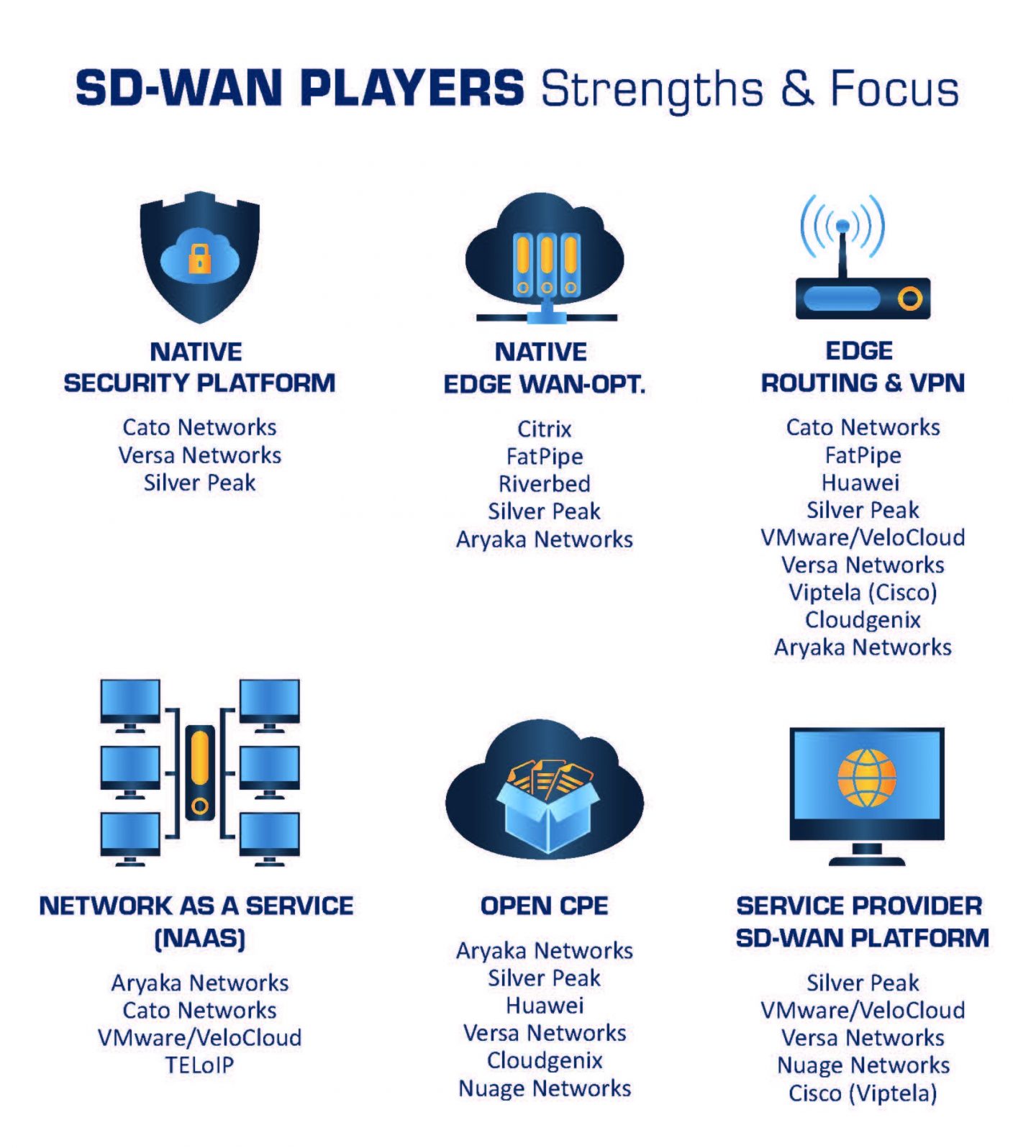

• Cato Networks and Versa Networks are focusing on security specialization. This has elevated the need for security integration into SD-WAN portfolios.

SDN-WAN Growth Outlook Details

You can purchase this premium Futuriom report by clicking on the button below. Use the discount code "FOFU" to get a 10% Friends of Futuriom discount.

Report Title: 2018 SD-WAN Growth Outlook

Length: 41 pages

Companies included: Aryaka Networks, Cato Network, Cisco/Viptela, CloudGenix,Cradlepoint, FatPipe, Nuage Networks (Nokia), Silver Peak, TELoIP, VeloCloud (VMware), Versa Networks

Price: $695

Terms: This is for a single-user license. Please contact sales at futuriom dot com for multi-user or enterprise license.

Related Articles

2024 SD-WAN/SASE Managed Services Survey Report

See what end users are looking for from SASE/SD-WAN services, according to our 2024 survey of 192 experts

Why AWS Private 5G Will Stir Up the Enterprise MarketAWS Private 5G models an ideal way for enterprises to adopt the technology while raising interesting questions about ecosystem go-to-market strategies

The Futuriom Q&A: Shailesh ShuklaAn interview with Shailesh Shukla, CEO and Chair of the Board of Directors at Aryaka