Are the Hyperscalers Betting Too Much on AI?

Despite hints of an AI reset following an initial hypefest, the cloud hyperscalers are sinking billions into artificial intelligence (AI). And the ripple effect is evident in recent earnings reports from their suppliers. But is it all a bubble about to burst?

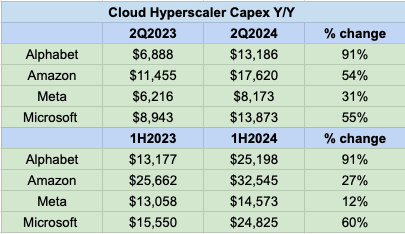

For the quarter ended June 30, Alphabet (Nasdaq; GOOG), Amazon (Nasdaq: AMZN), Meta (Nasdaq: META), and Microsoft (Nasdaq: MSFT) all showed dramatic increases in capital spending (capex). Collectively, they averaged a capex increase of 58% year-over-year (y/y) for the quarter, compared to 37% for Q2 2023. For the first half of 2024, their capex has grown an average of 48% y/y.

Source: Company reports

Each of the leading hyperscalers named AI in their recent earnings reports. Alphabet’s (outgoing) CFO Ruth Porat, for example, cited the need to build out the company’s technical infrastructure for AI as being behind a 91% increase in spending for both the first and second quarters 2024. And on the Microsoft call, CEO Satya Nadella compared the shift to AI with the move to cloud technology a few years back. "Similar to the cloud, this transition involves both knowledge and capital intensive investments," he said.

Suppliers Benefit from Hyperscaler AI Push

To access the rest of this article, you need a Futuriom CLOUD TRACKER PRO subscription — see below.

Access CLOUD TRACKER PRO

|

CLOUD TRACKER PRO Subscribers — Sign In |