What's Up with Snowflake?

Shares of Snowflake (NYSE: SNOW) plummeted nearly 20% today on lowered revenue guidance and news that the company’s CEO Frank Slootman is retiring.

First, the earnings: The report last night summarized the data management company’s fiscal 2024. Product revenues for the year came in at $2.7 billion, up 38% year-over-year (y/y), exceeding analyst expectations. Fourth-quarter product revenue was $738 million, up 38% y/y. Adjusted quarterly EPS was 35 cents, up 150% y/y. Total revenues for the year were $2.8 billion, up 36% y/y.

There was more good news: The company’s got $5.2 billion worth of remaining performance obligations, representing 41% growth y/y. There are 9,437 customers, 461 of which spend more than $1 million with Snowflake. There are plans to hire another 1,000 engineers next year.

Huge Valuation, Plus a Guide Down

Related Articles

AI Traffic Is Up, and So is Security Risk

Security platform provider Zscaler says enterprise users are diving into AI applications - and facing new AI cyberthreats

Databricks' AI Ambitions Revive IPO ChatterDatabricks' large language model DBRX was recently released to general applause. Could it be another step toward IPO?

Rubrik IPO Represents Larger TrendRubrik, the 11-year-old secondary storage and security cloud provider, is going public in a move that reflects an influx of new blood in the public tech markets

So why the stock crash? A big part of the problem is that Snowflake has a huge valuation -- $61 billion after today's meltdown -- which means huge expectations remain built in to the stock price. That's a price/sales ratio of about 24X, way above industry norms.

Investors were rattled to hear that Snowflake is guiding for first-quarter revenue between $745 million and $750 million, up 26% to 27% y/y. And for the full year, the company expects product revenue of $3.25 billion, up just 22%. To top things off, Slootman, the CEO who guided Snowflake through its IPO, has stepped aside for Sridhar Ramaswamy, who came aboard with Snowflake’s acquisition of intelligent search firm Neeva last May. Prior to co-founding Neeva, Ramaswamy was a high-ranking Google engineer for 15 years, the last five years as SVP of Ads and Commerce.

Sridhar Ramaswamy, CEO of Snowflake. Source: Snowflake

An AI Expert at the Helm

Both Slootman and Ramaswamy made it clear on the earnings call that the new CEO’s AI expertise is key to his appointment. “With the onslaught of generative AI, Snowflake needs a hard-driving technologist to navigate the challenges the new world represents,” said Slootman on the call. The departing CEO, who denied rumors of his potential departure last year, will remain chairman of the board.

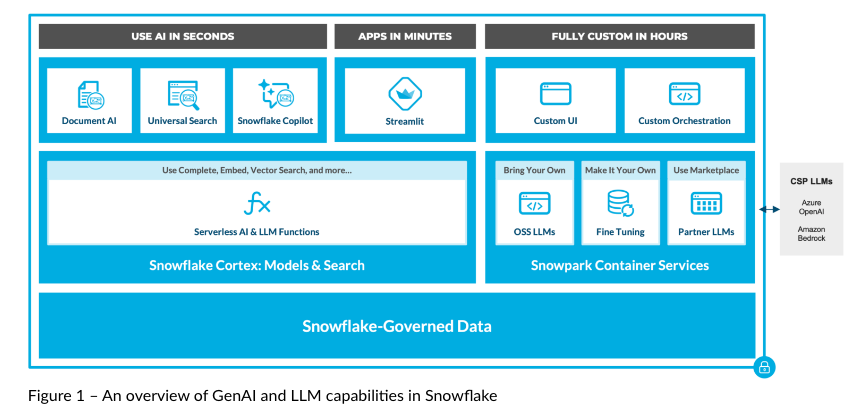

For his part, Ramaswamy seems enthusiastic about a spate of AI-enabled products coming out this year. Leading the charge is Cortex, a platform that allows developers to deploy serverless functions in accessing machine learning and generative AI (GenAI) large language models (LLMs). The point is that Snowflake customers can tap GenAI models without having to maintain expensive GPU infrastructure.

Cortex supports a GenAI Copilot for navigating data via natural language, and a Document AI capability for selecting data from document text. There’s also Snowpark Container Services, which will allows for the deployment of containerized applications on the Snowflake platform.

Overview of Snowflake Data platform. Source: Snowflake

All of this points to a key enterprise need: the management of data for use in creating GenAI applications.

“Snowflake is a once-in-a-generation company that will revolutionize the world with its cloud data platform,” said Ramaswamy on the earnings call. “This has become more true in the past year with the rapid technology innovations we have seen. Generative AI is at the forefront of my customer conversations. This drives renewed emphasis on data strategy in preparation for these new technologies.”

So What’s the Problem?

With a sizable pipeline of incoming business and a spate of hot products in preview, what, investors wanted to know, caused the disappointing guidance?

There appear to be a few elements. First, Snowflake doesn’t see IT spending improving to levels it was at before last year. “[W]e’ve revised our model to look at more recent history rather than going back too far in history for forecasting consumption patterns,” said Snowflake CFO Mike Scarpelli on last night’s call.

The company is also hesitant to put too much faith up front in new products. “We do expect … there'll be more workloads that will move to us, but until we see that incremental revenue on workloads, we're not going to forecast that,” said Scarpelli.

There’s also the case of no good deed going unpunished. By opening up the option for customers to store data elsewhere than on Snowflake – called Iceberg Tables for Snowflake, the company expects to see a dip in revenue for storage, which represents roughly 10% to 11% of overall sales.

Ultimately, Snowflake seems to be willing to play it safe in an environment where IT spending has gone down despite much hype and verbal demands for “AI everywhere.” Companies are taking longer to sign on the line, and there’s little evidence of a turnaround absent some shifts in the macro environment.

Still, there are signs that demand for AI-enabled products is indeed rising. Snowflake isn’t placing its future bets on a market that so far hasn’t quite materialized, however. It will be a few months, and perhaps another couple of quarters, before the company realizes the benefits of what it’s offering.

As of this writing, Snowflake shares were trading at $185.95, down -44.05 (-19.15%).

Futuriom Take: Snowflake’s conservative outlook tallies with a reasonable reticence regarding the enterprise market for GenAI. The new CEO seems uniquely equipped to navigate the shifting market. But the stock price still seems to reflect enormous growth expectations and will remain under pressure.

Related Articles

AI Traffic Is Up, and So is Security Risk

Security platform provider Zscaler says enterprise users are diving into AI applications - and facing new AI cyberthreats

Databricks' AI Ambitions Revive IPO ChatterDatabricks' large language model DBRX was recently released to general applause. Could it be another step toward IPO?

F50 Profile: Fivetran Grows Data Pipelines and CustomersIn 2023, Fivetran grew 50% in ARR and added thousands of customers because its data pipeline technology is meeting enterprise demand